Q.

How is Zakat treated in calculating for Income Tax? Provide an illustration to explain the treatment of Zakat in Income Tax Act, 1963.

A.

Income Tax Act 1963 provides that Zakat and Fitrah is allowable as rebate subject to the maximum tax charged - Sec 6A (3).

Personal Tax

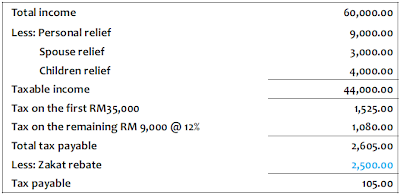

The following working illustrate the treatment of Zakat in calculating Personal Income Tax.

For the year ended 31 December, 2012, Ahmad received annual salary of RM60,000. His wife is not working and they have four school-going children. In February 2012, Ahmad paid RM2,500.00 for zakat on income. Therefore, income tax calculation for Ahmad:

Hence, Ahmad can choose to utilize this deduction to rebate all his zakat paid. In other words, Ahmad can choose to pay zakat instead of paying income tax!

Ref:

Musa Bin Othman (2013) Zakat and Tax Treatment, proceeding presented in National Business Zakat Symposium 2013, 8 Oct, 2013 viewed on 31 Dec, 2013 from http://www.mia.org.my/new/downloads/nbzs/2013/03-Zakat-And-Tax-Treatment.pdf