Q.

Determine the duty payable in the following cases:

a) Mrs Tan sold a parcel of residential land measuring 2.5 acres to Mr Deen in February 2013 for RM5 per sq foot. The private valuer engaged by Mr Deen prepared a valuation report valuing the property at RM6.50 per sq foot. However, the report submitted by the government valuer indicated a market value of RM7.00 per sq foot. (8 marks)

b) Mr Gan owned a parcel of agricultural land encompassing an area of 1.5 acres with potential to be developed as a single storey bungalow. The land is sold to Mr Kurrusamy for RM380,000 in Mac, 2013. The market value by the government valuer is RM280,000. The land was purchased by Mr Gan in January 2010 for RM250,000. The legal fees incurred is RM2,200 and he also paid an amount of 2% of the purchase price to an estate agent. (10 marks)

c) An apartment is leased to Mrs Namie for RM1,800 per month for a period of 5 years effective from February 2012. The tenant is responsible to pay the assessment rate of RM1,200 to local authority apart form maintenance fee of RM80 per month. (7 marks)

(25 marks, 2014 Q3)

A.

a)

Duty payable is based on the valuation by JPPH government valuer. In such case above, the stamp duty is calculated based on RM7.00 per sq foot.

(17.08.2015 Added for clarity) [When private valuation was done - for bank loan, etc. estimated stamp duty is paid according to private valuation. However, as the transaction of sale is submitted to JPPH, the office of JPPH will come out with a finalized valuation. This is the correct value to use. What ever the difference from this value would need to be accounted for. Thus, 6.50 to 7.00 psf would need a pay up of 0.50 psf difference.]

Once the Sale and Purchase Agreement (SPA) is signed, a copy of the SPA, the Memorandum of Transfer (MoT) which is Form 14A under the National Land Code, 1965 (for property with individual title); or Deed of Assignment (DOA) (if it’s a property without individual title) will be submitted to the Stamp Office/Revenue Service Centre (RSC) for adjudication. Adjudication is the process of determining the amount of stamp duty (“Ad Valorem”) payable for transfer of property.

Processing Stage – Adjudication of Form 14 A / Deed of Assignment (DOA)

Valuation by JPPH — Valuation and Property Services Department/Jabatan Penilaian dan Perkhidmatan Harta — is part of the stamping process by Stamp Office/RSC for cases where valuation is required.

Upon receipt of the application for valuation from the Stamp Office/RSC, JPPH will process the application and a valuation report will be prepared and subsequently sent back to the Stamp Office/RSC.

The time taken by JPPH to complete a valuation request is between 1 and 8 working days depending on the type of property. For standard property, it takes only one working day. A longer period maybe required if the property is a complex property, for example, shopping complex, multi-storey office building or industrial complex.

The Stamp Office/RSC will issue a Notice of Assessment either manually or online through “STPH” — Sistem Taksiran Pindah Milik Harta Tanah (also known as “STAMPS” — Stamp Assessment and Payment System). The Notice of Assessment will indicate the amount of stamp duty payable for the transfer of property. The rate of chargeable stamp duty will depend on the value of the property as prescribed by the Stamp Act, 1949. Payment must be made to the Collector of Stamp Duty through the Stamp Office/RSC within 30 days from the date of the Notice of Assessment. A penalty will be imposed for payment exceeding 30 days from the date of the Notice of Assessment.

This assessment would provide the value of the property and thus, be calculated the Stamp Duty due.

Ref:

Processing stage and registration stage of property transaction. News extracted from Business Times. 14 Mar, 2011, available from

http://www.kptg.gov.my/sites/default/files/docman/Processing%20stage%20and%20registration%20stage.pdf

b)

Jan 2010 - Mr Gan purchased the land RM250,000. Holding up to 2 years and 2 months till sold to Mr Kurrusamy.

Mar 2013 - Mr Kurrusamy purchased the land RM380,000 although Market Value of RM280,000.

Mr Gan

Stamp Duty: needs to pay stamp duty on RM250,000.

RPGT: acquired the land and hold on to it until sold in the 3rd year, following RPGT rate in force 2013. As Mr Gan incurred legal fee RM2,200 and a 2% commission to the Estate Agent when buying the land in 2010. These expenses can be deducted from the sale to arrive at a lesser gain. See below for the working:

Consideration Received: RM380,000

Less

(no further information provided, assume no agent fee, etc.)

= Disposal Price --------- RM380,000

Deduct

Consideration Paid: RM250,000

Add

Stamp Duty paid: RM1,000 (1% for the first 100,000)

RM3,000 (2% for the next 150,000)

Stamp duty = RM4,000

Legal Fee: RM2,200

Agent Fee on acquisition: 2% of RM250,000 = RM5,000

Subtotal = RM4,000 + RM2,200 + RM5,000 = RM11,200

= Acquisition Price is RM250,000 + RM11,200 = RM261,200

Chargeable RPGT Gain = RM380,000 - RM261,200 = RM118,800.

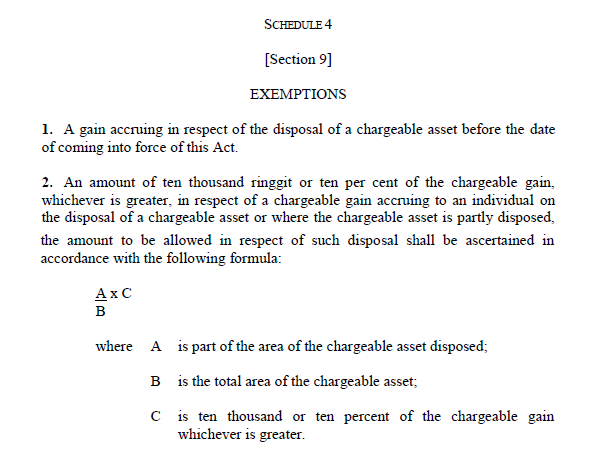

The personal exemption of 10% or RM10,000 whichever is higher on chargeable gains, as in Schedule 4, Para 2 of the RPGT Act as below:

Therefore the net chargeable Real Property Gains is:

RM118,800 - RM11,880 (10%) = RM106,920.

Upon this chargeable gain the RPGT Rate is 10% on the 3rd year.

Year of disposal = 2013, and holding period 3rd year, the RPGT rate was 10% following the TABLE above.

- 2010 Jan - 2011 Jan (1st year)

- 2011 Jan - 2012 Jan (2nd year)

- 2012 Jan - 2013 Jan (3rd year) & March falls within 3rd year.

The RPGT due from Mr Gan is RM10,692 (10% of RM106,920)

Mr Kurrusamy

Stamp Duty: needs to pay stamp duty on RM380,000, which is being greater of the Market Value RM280,000. Stamp Duty is calculated based on "whichever is the greater".

Stamp Duty calculation:

1st 100,000 @ 1% = RM1,000

Next 280,000 @ 2% = RM5,600

Total = RM6,600

Ref:

Earlier post on Standard format for RPGT calculation.

c)

An apartment is leased to Mrs Namie for RM1,800 per month for a period of 5 years effective from February 2012. The tenant is responsible to pay the assessment rate of RM1,200 to local authority apart form maintenance fee of RM80 per month. (7 marks)

Annual Rates for the property is RM1,200. Maintenance Fee of RM80 per month is payable to the Management Corporation of the Apartment.

Section 155 of the Local Government Act 1976 specifies that:

If the sum due from the owner of any holding on account of any rate or costs is paid by the occupier of such holding such occupier may, nothwithstanding anything contained in any agreement or arrangement with the owner, deduct from the next and following payments of his rent the amount which may have been so paid by him.

This means if the tenant Mrs Namie has paid RM1,200 for the assessment rate (annual rate) for the owner, she can choose to deduct it from the rental due to the owner. This being the duty outstanding and must be settled with the Local Authority when due.

The management fee to the management corporation of the apartment is a separate entity, and it is under the Strata Titles Act, 1985 and Strata Management Act, 2013.

The subjects on the above laws on Strata Titles are focus of the paper on Laws Relating to Property and Estate Agency Law.

Ref:

Section 155, Local Government Act, 1976, available at

http://www.agc.gov.my/Akta/Vol.%204/Act%20171.pdf