Q.

Any person who is dissatisfied with an assessment of the Collector under section 36 of the Stamp Duty Act 1949 may, by written notice object to the assessment and apply to the Collector to review the assessment. Thereafter, if he is still dissatisfied with the decision of the Collector he may submit an appeal against the decision to the High Court by filing a notice of appeal with the High Court.

Explain the above mentioned process of objection and appeal.

(25 marks, 2012 Q1)

A.

Similar question was asked in 2013 Q7b.

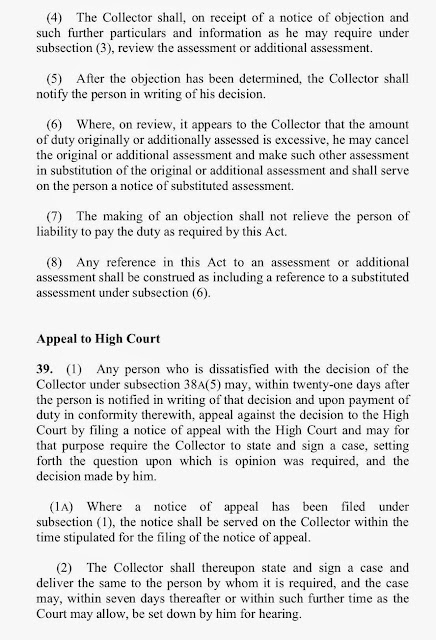

Sections 38A and 39 of Stamp Act 1949 spell out Appeal and matters related to High Court procedures on appeal.

Ref:

S.38A and S.39 of Stamp Act 1949, available at

http://www.agc.gov.my/Akta/Vol.%208/Act%20378%20-%20Stamp%20Act%201949.pdf