Q.

What are the available exemptions to Stamp Duty (as of 2015)?

A.

Stamp Duty changes over time due to policy of government in its tax collection. Multiplied by measures to curb property speculation and reasons like encouraging lower income group to acquire property by removing the cost incurred, stamp duty varies from time to time.

From websites of iProperty:

MAKING GIFTS OF PROPERTY

Changing the ownership of a property is neither simple nor cheap. Aside from the legal costs of dealing with the transfer, you will need to reckon with stamp duty and possibly real property gains tax (RPGT). Careful planning will ensure that a property is registered in the right ownership at the time of acquisition so that expensive title transfers do not have to be made later.

Stamp duty can be costly at 1% on the first RM100,000 of value, 2% on the next RM400,000 and 3% on the remainder. Generally, it applies based on the market value of a property when a gift is made, but the good news is that a remission is available for certain family dispositions. Transfers between husband and wife qualify for complete remission of the duty payable and transfers from father and/or mother to a child attract a 50% remission.

Ref:

See more at: http://www.iproperty.com.my/news/2767/estate-tax-planning-in-malaysia#sthash.b373M9Vt.dpuf

07/09/2007 Bernama.com

KUALA LUMPUR, Sept 7 (Bernama) -- The government is proposing that the instruments for transfer of property between husband and wife on the basis of "love and affection" be exempted from stamp duty.

"The proposal is effective Sept 8, 2007," said Prime Minister Datuk Seri Abdullah Ahmad Badawi, who is also finance minister, when tabling the Budget 2008 at Parliament today.

In the case of a transfer of property between family members by way of love and affection, the law provides for a full or partial exemption of stamp duty and/or RPGT in certain instances.

Stamp Duty on Transfer by Love and Affection

Pursuant to the Stamp Duty (Exemption) (No. 10) Order 2007, the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows:

| Transferor | Transferee | Exemption Rate |

| Husband | Wife | 100% |

| Wife | Husband | 100% |

| Mother and/or father | Child | 50% |

| Child | Mother and/or father | 50% |

Note that ‘Child’ means a legitimate child, a step child or child adopted in accordance with any law. Also, stamp duty is typically paid by the transferee, unless agreed otherwise by parties.

Ref:

Transfer between family members by MahWengKwai.com

From the website of Lembaga Hasil Dalam Negeri, it is specified that:

EXEMPTIONS / RELIEF FROM STAMP DUTY

General exemptions under Section 35 in First Schedule, Stamp Act 1949 and Specific exemptions under item 2, 4 and 32 in First Schedule, Stamp Act 1949.

Section 35 is a general exemption: extract here

1. The above exemption does not extend to any instrument or writing signed or executed by any officer as Official Administrator (or, in the case of Sabah, as Administrator General) or Public Trustee or by a receiver appointed by the Court; or to any instrument rendered necessary by any written law or order of Court; or to a sale made for the recovery of an arrear of revenue or in satisfaction of a decree or order of Court.

All instruments of any kind whatsoever, and all counterparts or duplicates of such instruments, made or executed by or on behalf or in favour of a Ruler of a State or the Government of Malaysia or of any State, where, but for this exemption, the Ruler or the Government would be liable to pay the duty chargeable in respect of such instrument.

2. Any grant or lease made on behalf of the Government by virtue of the National Land Code [Act 56 of 1965] or the National Land Code (Penang and Malacca Titles) Act 1963 [Act 518] or the Land Ordinance of Sabah [Sabah Cap.68] or the Land Ordinance of Sarawak [Sarawak Cap.81].

3. Any instrument for the sale, transfer or other disposition, either absolutely or by way of charge or otherwise, of any ship or vessel or any part, interest, share or property of or in any ship or vessel registered or licensed under the Merchant Shipping Ordinance 1952 [Ord. 70 of 1952] or under any law for the time being in force in any part of Malaysia.

4. Any instrument relating exclusively to immovable property situate out of Malaysia or relating exclusively to things done or to be done out of Malaysia.

5. All instruments relating solely to the business of any society registered under any written law relating to co-operative societies, and executed by an officer or member of such society, the duty on which would, but for the exemption hereby granted, be payable by such officer or member.

6. An instrument executed pursuant to a scheme of financing approved by the Central Bank, the Labuan Financial Services Authority, the Malaysia Co-operative Societies Commission or the Securities Commission as a scheme which is in accordance with the principles of Syariah, where such instrument is an additional instrument strictly required for the purpose of compliance with those principles but which will not be required for any other schemes of financing.

Over time, there were other P.U. issued on Stamp Duty Exemptions being introduced. I try to give examples and summarize them in a list below.

Another part is RELIEF

Relief may be given pursuant to Section 15 and Section 15A, Stamp Act 1949:

Section 15 Relief from Stamp duty in case of reconstructions or amalgamations of companies.

Section 15A Relief from Stamp Duty in case of transfer of property between associated companies.

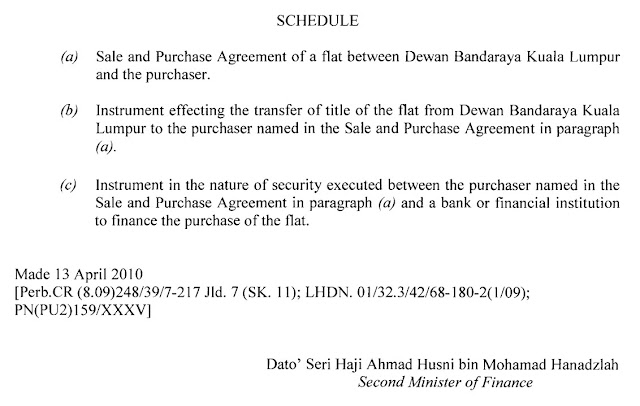

P.U.

For example:

P.U. (A) 410 which is exemption for 'Green Building'.

Stamp duty on loan agreements for purchase if residential properties is 0.5% on loan value.

Full stamp duty exemption only on low cost residential up to RM42,000 in Peninsular Malaysia and RM47,000 in Sabah, Sarawak and Labuan.

Stamp duty exemption of 50% is given on loan agreements for first residential property up to RM350,000 if SPA executed between 1 Jan 2011 to 31 Dec 2012.

Budget 2015 extended the 50% exemption until 31 Dec 2016 for Youth Housing Scheme (PR1MA) and increased the limit from to RM500,000.

*Update: The new limit entitlement for the 50% stamp duty exemption is now for properties RM500,000 and below in accordance to Budget 2015. This will take effect starting 1st Jan, 2015 until 31 Dec, 2016.

Affordable Housing

-

First House Deposit Financing

-

RM200 million allocated for helping the first house buyers for their down payment.

-

-

20% Stamp Duty Exemption:

-

Shariah-compliant loan instruments to finance home purchases, encouraging Shariah financing and to reduce cost of home ownership.

-

-

RM40 million is allocated for the rehabilitation of abandoned public housing projects.

-

Stamp duty exemption for rescuing contractors and the original buyers of the abandoned houses.

-

RM60 million is allocated for the construction of housing for the Orang Asli community.

Ref:

https://loanstreet.com.my/learning-centre/guide-first-home-buyer

https://loanstreet.com.my/learning-centre/the-budget-2016-have-your-requests-been-fulfilled