Q.

With reference to the Stamp Act 1949 (As amended), calculate the stamp duty payable on the following cases;

(a) Kah Mah sold a piece of land with 6,000 square metre to Ah Lee in August 2014 for RM100.00 per square metre. Private valuer appointed by Ah Lee is of the opinion that the value is only RM85.00 per square metre. (5 marks)

(b) Ramasamy bought 5 hectares of land with development potential on March 2010 valued at RM250,000. He sold the said land to Mek Su for RM500,000 on October 2014 as estimated by a private valuer. The government valuer thereafter valued the land at RM750,000.

(c) A&W leased a 500 square metre of retail space in Lot 10 Shopping Complex at RM50.00 per square metre per month. It is a lease for a 5 year term commencing on the 1st January 2015. A&W has to pay maintenance fees of RM20.00 per square metre and assessment to Dewan Bandaraya Kuala Lumpur.

(25 marks, 2015 Q6)

(21.09.2015)

A.

(a) Kah Mah - 6,000 sq meter, RM100 / sqm. Value equals to consideration paid (6,000 x 100 = RM600k) or Market Value (6,000 x 85 = RM510k), whichever is higher.

Consideration paid RM600,000 is higher, thus Stamp Duty is calculated based on RM600k.

First 100,000 ... 1% = RM1,000 (100,000 x 1/100)

Next 101,000 - 500,000 ... 2% = RM8,000 (400,000 x 2/100)

The remaining RM100,000 ... 3% = RM3,000 (100,000 x 3/100)

Total = 1,000 + 8,000 + 3,000 = RM12,000.

Stamp Duty payable by Ah Lee who is the purchaser is RM12,000.

(b) Ramasamy - 5 hectares land. Sold with Government Valuation RM750,000. Stamp Duty follows government valuation of RM750,000.

First 100,000 ... 1% = RM1,000 (100,000 x 1/100)

Next 101,000 - 500,000 ... 2% = RM8,000 (400,000 x 2/100)

501,000 - 750,000 ... 3% = RM7,500 (250,000 x 3/100)

Total = 1,000 + 8,000 + 7,500 = RM16,500.

Stamp Duty payable by Mek Su who is the purchaser is RM16,500.

(c) Stamp Duty on Rental, SPA and Loan was posted earlier here.

A&W lease 500 sqm Lot10, RM50 per sqm per month for 5 years term. RM20 per month of maintenance fee by A&W.

(Rental used in Stamp Duty calculation is by Gross Rental - just like Market Value)

1. Yearly rental = RM50 x 500 x 12 = RM300,000.

2. Exemption for first RM2,400 rental which makes the actual rental for stamp duty as RM300,000 - RM2,400 = RM297,000

3. Multiplier is calculated as RM297,000 / RM250 = 1190.4 (round up to 1191)

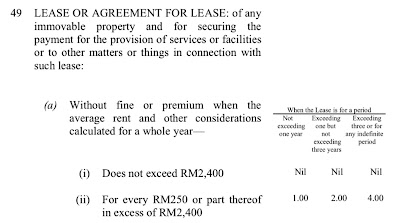

4. This multiplier is used to multiply with the rate which is RM4 (when tenancy is 4 years and above)

RM4 x 1191 = RM4,761.60.

Stamp Duty due by A&W for the 5 years lease is RM4,761.60.

The table of Rates is extracted from First Schedule, Item 49 (a), Stamp Act 1949 as below:

Ref:

Earlier post listed above.

Stamp Act, 1949 - First Schedule, Item 49 (a).