Q.

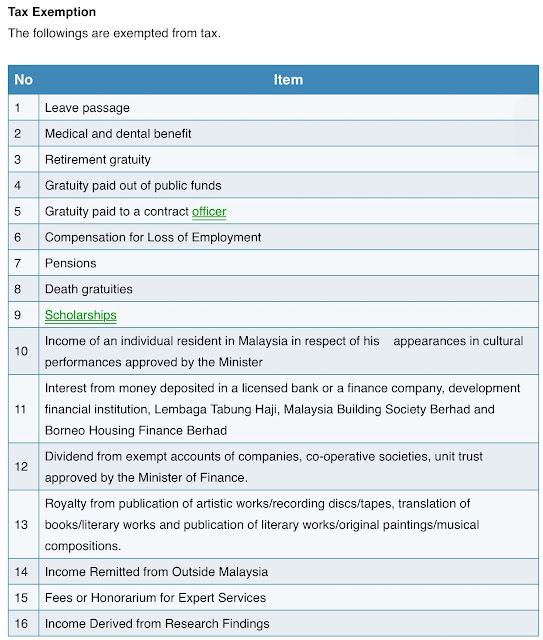

(a) State any five (5) classes of income that are exempted from Income Tax. (10 marks)

(b) With examples give any five (5) types of income which are subjected to Income Tax. (15 marks)

(25 marks, 2015 Q5)

A.

Ref:

2014 Income Tax Exemptions, Deduction, Rates, Reliefs and Rebates, available at

2014 Income Tax Exemptions, Deduction, Rates, Reliefs and Rebates

SCHEDULE 6 - Exemptions From Tax. PART I INCOME WHICH IS EXEMPT, available at

http://www.kpmg.com.my/kpmg/publications/tax/22/a0053sc006.htm

Akta Cukai Pendapatan 1967, pindaan. Part X, available at

http://www.hasil.gov.my/pdf/pdfam/4542.pdf

(b)

Classes of income on which tax is chargeable

Section 4. Subject to this Act, the income upon which tax is chargeable under this Act is income in respect of-

(a) gains or profits from a business, for whatever period of time carried on;

(b) gains or profits from an employment;

(c) dividends, interest or discounts;

(d) rents, royalties or premiums;

(e) pensions, annuities or other periodical payments not falling under any of the foregoing paragraphs;

(f) gains or profits not falling under any of the foregoing paragraphs.

Ref: