Q.

(b) Daud bought a double storey terraced house on 20th August 2011 for RM400,000. One month later, the car porch leaned and Daud succeeded in recovering RM10,000 by way of damages from the developer. In September, 2013, he made a renovation to the house costing RM50,000. In November the same year, Haikal entered into an agreement to buy the property and he paid a deposit of RM30,000. However, Haikal failed to secure a bank loan and the sale was aborted and the deposit was forfeited. In June, 2014, Daud sold the property for RM700,000 and incurred the following expenses for the sale:

Valuation fee-----------------RM6,700

Cost of advertisement-------RM1,200

Agency fee--------------------RM10,000

Calculate Real Property Gains Tax payable by Daud. (15 marks)

(15 marks, 2015 Q3b)

(21.09.2015)

A.

The format on RPGT Calculation is posted here by SM Thanneermalai, from Accountants Today, Oct 2010.

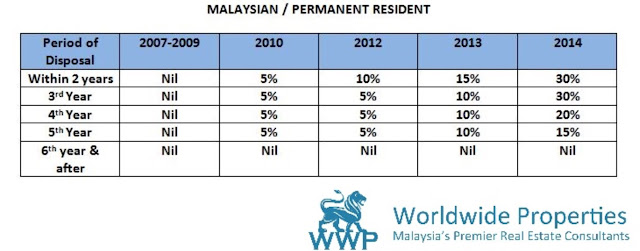

The date of Acquisition was 20 Aug, 2011, and disposal in Jun, 2014 means the holding period was less than 3 years (19 Aug, 2013 is completion of 2 years). Thus, the disposal was in the 3 years. The rate of RPGT was 30% in 2014 for within 3rd year.

Historical rates has been extracted from 'A view into the history of Malaysian Real Property Gains Tax rates' from Worldwide Properties - RPGT here.

The various items of transactions can be grouped into 3 categories:

1. Incidental costs - valuation fee, advertisement & agency fee = RM17,900;

2. Permitted Expenses - enhancement = RM50,000;

3. Recoveries - claim from developer, deposit forfeited = RM40,000.

Calculation of Disposal Price:

Consideration received

LESS

Incidental costs ..........RM17,900

Permitted Expenses ....RM50,000

Disposal Price = 700,000 - 17,900 - 50,000 = 632,100

Calculation of Acquisition Price:

Consideration paid

ADD

Stamp Duty ... First 100k (1% = 1,000) + next 300k (2% = 6,000) ... RM7,000

LESS

Recoveries ... RM40,000

Acquisition price = 400,000 + 7,000 - 40,000 = 367,000

Gains from disposal by Daud - Disposal Price - Acquisition Price = 632,100 - 367,000 = 265,100

LESS Sch 4 Exemption of RM10,000 or 10% whichever is greater - 10% of 265,100 = RM26,510

LESS any RPGT loss brought forward from previous year - assume none = 0

TOTAL Chargeable RPGT Gains = 265,100 - 26,510 - 0 = 238,590

Real Property Gains Tax Payable by Daud @ 30% is 238,590 x 30% = RM71,577.

Ref:

Own account.