Q.

(a) Under the Real Property Gains Tax Act 1976, explain the following:

i) Incidental Cost (5 marks)

ii) Disposal Price (5 marks)

(b) Alex bought a double storey factory building from a developer on 20th August 2012 for RM2,400,000. Six months later, part of the toilet sank and Alex succeeded in recovering RM50,000 for the defect from the developer. In September 2013, he renovated the building costing RM550,000. In November the same year, Rama entered into an agreement to buy the property and paid a deposit of RM50,000. However, Rama failed to secure a bank loan and the sale was aborted and the deposit was forfeited. In June 2014, Alex sold the property for RM4,700,000 and incurred the following expenditure for the sale:

Valuation fee - RM10,700

Cost of advertisement - RM3,500

Agency fee - RM20,000

Calculate Real Property Gains Tax payable by Alex. (15 marks)

(25 marks, 2016 Q3)

A.

a)

(i) Incidental costs

Schedule 2, para 6 is referred below.

6. (1) For the purposes of paragraphs 4 and 5 the incidental costs of the acquisition or disposal of an asset shall consist of expenditure wholly and exclusively incurred by the disposer for the purposes of the acquisition or (as the case may be) the disposal, being—

- (a) fees, commission or remuneration paid for the professional services of any surveyor, valuer, accountant, agent or legal adviser;

- (b) costs or transfer (including stamp duty);

- (c) in the case of an acquisition, the cost of advertising to find a seller and, subject to subparagraph (2), any interest paid on capital employed to acquire the asset; and

- (d) in the case of a disposal, the cost of advertising to find a buyer and costs reasonably incurred for the purposes of this Act in making any valuation or in ascertaining market value.

(2)Where the interest paid on capital employed to acquire an asset is expenditure of the kind mentioned in subsubparagraph 7(a), (b) or (c), it shall be disregarded for the purposes of subsubparagraph (1)(c).

(ii) Disposal price

Schedule 2, Para 5 is referred below.

5. (1) Subject to subparagraph (2), the disposal price of an asset is the amount or value of the consideration in money or money’s worth for the disposal of the asset less—

(a) the amount of any expenditure wholly and exclusively incurred on the asset at any time after its acquisition by or on behalf of the disposer for the purpose of enhancing or preserving the value of the asset, being expenditure reflected in the state or nature of the asset at the time of the disposal;

(b) the amount of any expenditure wholly and exclusively incurred at any time after his acquisition of the asset by the disposer in establishing, preserving or defending his title to, or to a right over, the asset; and

(c) the incidental costs to the disposer of making the disposal. (2) Where an asset which is disposed of was acquired by the disposer prior to 1 January 1970, the amount of the expenditure of the kind mentioned in subsubparagraphs (1)(a) and (b) which relates to the period prior to 1 January 1970 shall be disregarded.

Ref:

Schedule 2, Paragraphs 5 and 6, Real Property Gains Tax Act, 1976.

b)

Alex double storey factory building - RPGT Calculation

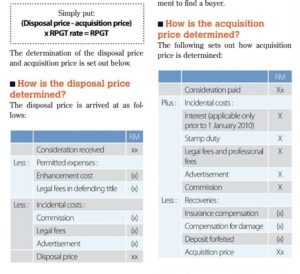

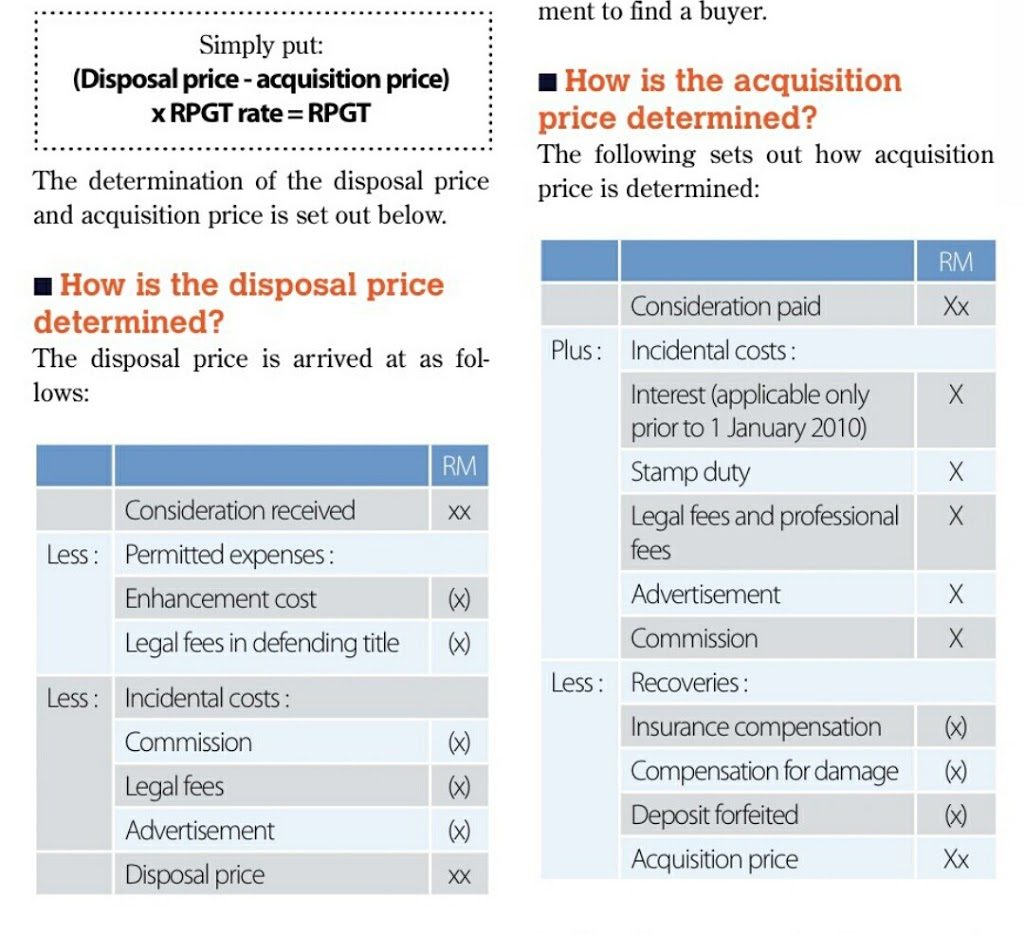

Disposal Price

Consideration received : RM4,700,000

Less: Permitted expenses

Enhancement cost - RM550,000

Less: Incidental costs

Commission - RM20,000

Valuation fee - RM10,700

Advertisement - RM3,500

Disposal price = RM4,115,800

Acquisition Price

Consideration paid : RM2,400,000

Plus: incidental costs

Stamp duty* @ RM2,400,000 = RM66,000

Less: Recoveries

Compensation for damage - RM50,000

Deposit forfeited by Rama - RM50,000

*Stamp duty was

100,000 @ 1% = RM1,000

400,000 @ 2% = RM8,000

1,900,000 @ 3% = RM57,000

Total Stamp Duty = RM66,000

Acquisition Price = RM2,366,000

RPG = Disposal Price - Acquisition Price

=> RM4,115,800 - RM2,366,000 = RM1,749,800

LESS Sch 4 Exemption of RM10,000 or 10% whichever is greater - 10% of 1,749,800 = RM174,980

=> RM1,749,800 - RM174,980 = RM1,574,820

Date of acquisition = 20th August 2012

20/8/2012 to 19/8/2013 - 1st year

20/8/2013 to 19/8/2014 - 2nd year

Date of disposal = June, 2014 (within 2nd year)

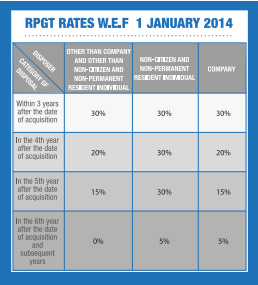

The tax rate follow the below table:

For disposal within 3 years, the disposer is imposed 30% RPGT rate. Hence,

RPGT payable is:

RM1,574,820 x 30% = RM472,446

Ref:

Own account.