Q.

(a) Explain any TWO (2) of the following types of money.

(i) Commodity Money

(ii) Fiat Money

(iii) Legal Tender

(iv) Token Money

(v) Demand Deposits/Current Accounts (5 marks)

(b) Explain any TWO (2) functions of money. (5 marks)

(c) With the aid of a diagram, explain the FOUR (4) phases of Business Cycle. (15 marks)

(25 marks, 2016 Q5)

A.

a)

(i) Commodity Money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects that have value in themselves (intrinsic value) as well as value in their use as money.[1]

Example of commodities that have been used as mediums of exchange include gold, silver, copper, salt, peppercorns, tea, large stones (such as Rai stones), decorated belts, shells, alcohol, cigarettes, cannabis, candy, cocoa beans, cowries and barley. These items were sometimes used in a metric of perceived value in conjunction to one another, in various commodity valuation or price system economies.

(ii) Fiat Money

Fiat is the Latin word for "it shall be."

The fiat money need to be controlled as it may affect entire economy of a country if it is misused. Today Fiat money is the basis of all the modern money system. The real value of fiat money is determined by the market forces of demand and supply.

Ex : Paper money, Coins

Most modern paper currencies are fiat currencies; they have no intrinsic value and are used solely as a means of payment. Historically, governments would mint coins out of a physical commodity, such as gold or silver, or would print paper money that could be redeemed for a set amount of physical commodity.

Fiat money is inconvertible and cannot be redeemed. Fiat money rose to prominence in the 20th century, specifically after the collapse of the Bretton Woods system in 1971, when the United States ceased to allow the conversion of the dollar into gold.

Ref:

Fiat Money http://www.investopedia.com/terms/f/fiatmoney.asp#ixzz4rPRQcdmw

(iii) Legal Tender

"coins or banknotes that must be accepted if offered in payment of a debt."

Legal tender is any official medium of payment recognized by law that can be used to extinguish a public or private debt, or meet a financial obligation. The national currency is legal tender in practically every country. A creditor is obligated to accept legal tender toward repayment of a debt. Legal tender can only be issued by the national body that is authorized to do so, such as the U.S. Treasury in the United States and the Royal Canadian Mint in Canada.

Ref:

Legal Tender Definition | Investopedia http://www.investopedia.com/terms/l/legal-tender.asp#ixzz4rPS6qSdg

(iv) Token Money

Token money is money whose face value exceeds its cost of production. Most modern coins used in circulation are token money, as are paper notes. It is a subsidiary of standard money.[1] Token money is exchanged at a value rate independent from its commodity value.[2] If the money is metallic it is made out of inferior metals such as copper and nickel.[1]

Ref:

https://en.wikipedia.org/wiki/Token_money

(v) Demand Deposits/Current Accounts

"a deposit of money that can be withdrawn without prior notice."

A demand deposit consists of funds held in an account from which deposited funds can be withdrawn at any time from the depository institution, such as a checking (current) or savings account, accessible by a teller, ATM or online banking.

Ref:

Demand Deposit http://www.investopedia.com/terms/d/demanddeposit.asp#ixzz4rPT7G117

(b) 2 functions of money

Similar question was asked in

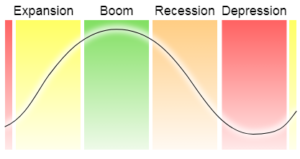

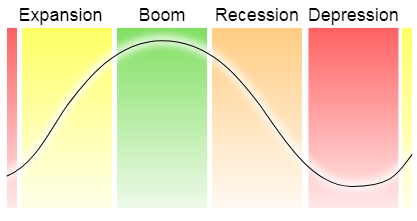

(c) 4 phases of Business Cycle

Business Cycle means "a cycle or series of cycles of economic expansion and contraction".

Business cycles are identified as having four distinct phases: expansion, peak, contraction, and trough.

Business Cycles

The phases of a business cycle follow a wave-like pattern over time with regard to GDP, with expansion leading to a peak and then followed by contraction leading to a trough.

Ref:

https://www.boundless.com/economics/textbooks/boundless-economics-textbook/introduction-to-macroeconomics-18/key-topics-in-macroeconomics-91/the-business-cycle-definition-and-phases-342-12439/images/business-cycles/

More detailed explanation is extract for further reading below:

Each business cycle has four phases. They are expansion, peak, contraction and trough. They don’t occur at regular intervals. But they do have recognizable indicators.

Expansion is between the trough and the peak.

That's when the economy is growing. Gross domestic product, which measures economic output, is increasing. The GDP growth rate is in the healthy 2-3 percent range. Unemployment reaches its natural rate of 4.5 to 5.0 percent. Inflation is near its 2 percent target. The stock market is in a bull market. A well-managed economy can remain in the expansion phase for years. That's called a Goldilocks economy.

The expansion phase nears its end when the economy overheats. That's when the GDP growth rate is greater than 3 percent. Inflation is greater than 2 percent and may reach the double digits. Investors are in a state of "irrational exuberance." That's when they create asset bubbles.

The peak is the second phase. It is the month when the expansion transitions into the contraction phase.

The third phase is contraction. It starts at the peak and ends at the trough. Economic growth weakens. GDP growth falls below 2 percent.

When it turns negative, that is what economists call a recession. Mass layoffs make headline news. The unemployment rate begins to rise. It doesn’t happen until toward the end of the contraction phase because it's a lagging indicator. Businesses wait to hire new workers until they are sure the recession is over.

Stocks enter a bear market as investors sell.

The trough is the fourth phase. That's the month when the economy transitions from the contraction phase to the expansion phase. It's when the economy hits bottom. (Source: "The National Business Cycle Dating Procedure: Frequently Asked Questions," National Bureau of Economic Research.)

The business cycle's four phases can be so severe that they’re also called the boom and bust cycle.