Q.

What is rental method of rating valuation and when should it be used?

A.

Go here to read the article from its original site. This is verbatim from the original site.

The rental method should be used where the hereditament belongs to a class of property which is generally let in the open market - provided, of course, that the necessary evidence exists. The valuer is comparatively unfettered in the way in which they uses this method.

Direct rental evidence

Direct rental evidence is the rent of the hereditament being valued. Although this is evidence of rental value, it is by no means conclusive. It is seen as prima facie evidence liable to be rebutted (Baker Britt & Co Ltd v Hampsher (VO) (1976)).

Rental evidence may be rebutted in several ways.

- The rent may not reflect the terms of the hypothetical tenancy under the definition of RV. For example, a yearly tenancy is unusual in most property markets.

- It is rare to find a rent that is on terms exactly matching the definition of rateable value. For example, the rent may not have been set at the antecedent valuation date.

- Even if the tenancy were on the statutory terms, it would not necessarily lead to acceptance of the rent as RV. In R v Paddington Valuation Officer ex parte Peachey Property Corporation Ltd (1964) the court went as far as to say that ‘the actual rent payable at the date of assessment is not conclusive … even if the terms of the current letting are the hypothetical statutory terms’.

- The rent may be between related parties.

Any rent is agreed in the (imperfect) property market. If the agreement were to be made again, a different rent might be agreed. Nevertheless, if no fault is found with the actual rent, it has to be the best guide to rateable value.

Indirect rental evidence

Indirect rental evidence is evidence of lettings of comparable properties. If, for example, the hereditament is a shop or office, there is likely to be a body of evidence that can be analysed.

Again, however, it is unlikely that such lettings will conform to the statutory tenancy, and they are subject to the same cautions as outlined above.

Use of evidence

- they are not open market rents - such as rents between family members or related companies; or because

- they cannot be made to conform to the rating hypothesis - such as a rent on long leases without review.

On the other hand, many open market rents, whilst not conforming to the terms of the rating hypothesis, can be adjusted to conform, being translated into a ‘rent in terms of rateable value’. This can then be analysed and reduced to a comparative basis such as £/m², or £/m² ITZA (in terms of Zone A) for retail properties.

The basket of evidence

- look at the rental evidence as a whole;

- compare the results of analysis using adjusted rents;

- attach weight to each piece of evidence, depending on how reliable the valuer considers it to be;

- draw a conclusion from all the evidence available as to what rent a hypothetical landlord and tenant might agree under the rating terms.

Hierarchy of evidence

Whether the rent is the actual rent in question, or a rent arising from a comparable property, or an assessment arising from a Profits/Receipts or Contractor’s Test valuation, the weight (or dependability) to be attached to it by tribunals and courts is reliant on its place in the hierarchy of evidence and its being tested against other evidence.

Case law

The cases Robinson Bros (Brewers) Ltd v Houghton and Chester-le-Street Assessment Committee (1937) and Garton v Hunter (VO) (1969) have looked at the hierarchy of evidence.

In Robinson Bros, the Court of Appeal accepted that direct rental evidence on the subject hereditament (or on a truly comparable hereditament) was ‘the best evidence’; indirect evidence was admissible only in cases where direct evidence was lacking.

In Garton v Hunter (VO), the court adopted a ‘modern’ view and held that all relevant evidence was admissible, but the value put on the evidence had to be weighted. Winn LJ stated:

‘Where the particular hereditament is let on what is plainly a rack-rent and there are similar hereditaments and similar economic sites which are so let that they are truly comparable, that evidence should be classified in respect of cogency as a category of admissible evidence properly described as superior; in some, but not all, cases, that category may be exclusive. Any indirect evidence, albeit relevant, should be placed in a different category; reference to the latter category may or may not be proper, or indeed necessary, according to the degree of weight of the former kind of evidence.’

The hierarchy of evidence is as follows:

- Rents, where the lease is agreed at the AVD on identical terms cited by the statutory definition of RV.

- Rents, where the lease is agreed prior to the AVD on terms closely associated with the statutory definition.

- Rents, where the lease requires little adjustment to conform to the terms cited by the statutory definition.

- The more adjustments made to a rent to accord to the statutory definition, the ‘weaker’ it becomes.

- Rents from leases agreed after the AVD are less helpful, although they still form part of the ‘basket of evidence’. Such evidence may be best used as indicators of market trends since the AVD.

- Open market lettings are generally the strongest evidence, assuming that the property has been freely exposed to the market over a reasonable period of time. Care still needs to be taken that such transactions are representative of market value and do not, for example, reflect the desperation of a tenant to secure space, or the need for a landlord to secure immediate income. A range of evidence is therefore needed in order to help isolate such effects.

- lRent reviews and lease renewals (in England and Wales, where the tenant has rights to a new lease) are based on market value, as prescribed by the lease and statute respectively. Such transactions are generally representative of the level of rent achieved at open market letting, although they can be influenced by factors such as the availability of comparable evidence. This is a close second-best evidence to open market lettings.

- A contracted-out letting (in England and Wales, where the tenant has no security of tenure at lease expiry) and a lease renewal in Scotland (as the tenant has no rights to renew) are less reliable as open market evidence. A new letting on a contracted-out basis may command a lower rent than if security of tenure is provided, and therefore warrant an upward adjustment to the rent on the subject property which benefits from security of tenure. A renewal of the lease to the same tenant at expiry of the contracted-out letting could see the landlord exploit the tenant's lack of rights, and, with relocation not being feasible and/or expensive, a rent above market rent could be achieved and thus warrant a downward adjustment to the rent on the subject property.

- a sale and lease-back (as the owner sets a rent to achieve the investment sale);

- surrender and renewal (as this usually reflects special requirements of one or both of the parties); and

- inter-company arrangements (where internal rent charging may simply be set by an accountant).

Adjustments of rents

Where property has to be valued to RV, the rents used for comparison should be adjusted to accord with ‘rent in terms of RV’.

Actual rents may have to be adjusted for any one of the following to accord with the definition of RV:

Repairing and insuring liabilities.

- Service charges.

- Premium paid.

- Improvements not included in the rent passing.

- Year-to-year assumption.

- ‘Turn over’ element, rent-free period or other concessions.

- VAT.

- Domestic element of rent.

- Date of rent.

Repairs and insurance

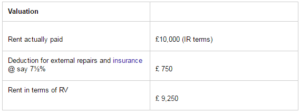

Example 1

A property was let on the open market on the antecedent valuation date for five years at a rent of £10,000 per annum. The lease required the tenant to repair the interior of the property only and to use the premises solely for offices in class A2 of the Use Classes Order (financial services etc). Estimate the likely assessment, based on the rent passing.

- Date of valuation. The date of the letting is the antecedent date; no adjustment for date.

- Repairing assumptions. For RV, it must be assumed that the tenant is responsible for all repairs and insurance, therefore deduct cost of external repairs and insurance to give net rent. Where the landlord is responsible for all repairs, then the usual deduction is 10 percent. This is not a hard and fast rule and circumstances may require the deduction of different percentages; for example, 5 percent if the landlord carries out external repairs only and 2½ percent if the landlord carries out insurance only.

- User restriction must be ignored under the definition of RV. The rent to be found is ‘vacant and to let’. Assume here that financial services are the highest and best use, therefore no adjustment of rent is needed to reflect ‘vacant and to let’ assumption.

If a rent includes payment for services rendered by the landlord (other than the provision of accommodation), it must be reduced to find the net rent being paid for the premises alone.

If a separate service charge is made in addition to the rent, it is not usually necessary to adjust the rent. However, in recent years landlords have been criticised for setting excessive service charges, and it has been suggested that there is a hidden element of rent in such charges. It is important, therefore, to consider the reasonableness of the charge: excessively high or low charges may indicate that the rent requires adjustment, or may cast doubt on its reliability.

Premiums

If a tenant pays a premium in addition to rent, this normally means that the rent passing is below the open market rent (as required for RV) - that is, there is a profit rent. Alternatively the premium could represent ‘key money’.

Premiums are decapitalised and added to the rent passing. The period of amortisation requires great care. If the premium is truly capitalised profit rent, it should be amortised over the period to the first review or renewal where the basis is ‘open market rental value’ (OMRV).

The treatment of key money is a difficult area, and opinion is divided on how it should be approached. It could be argued that the interaction of supply and demand simply results in the payment of key money, in the same way that interaction determines rental values. Alternatively, key money can be seen as a payment solely to obtain occupation and, with it, the ability to trade and earn a profit. The premium therefore represents the opportunity cost of occupation and not profit rent.

It is suggested that any element of key money should be amortised over the expected occupancy of the tenant.

However, be aware that the discounting of a premium paid on an assignment is often unrepresentative of an equivalent market rent, because, in practice, the premium is more likely to relate to the current tenant’s wish to relinquish space and the relative unattractiveness to prospective occupiers of a short lease length and other non-

negotiable terms, compared with a direct letting to a landlord.

In Example 2, a tenant pays a premium of £10,000 and a net rent of £20,000 per annum; the lease is for 20 years with a review to OMRV after 5 years.

It is understood that for the 1995 and 2000 rating lists the VO has adopted different single rate figures according to the type of properties concerned, varying from 8% for, say, shops to 11% for, say, factories in 1995, and 7% to 10% in 2000.

Note: Any rent which includes a significant element derived from an amortised premium must be treated with caution, as the reasons for the premium being paid are rarely clear and are often confidential.

An incoming tenant could also pay a premium to receive the fixtures and fittings left by the outgoing tenant. As this does not relate to rent, it should not be decapitalised.

Improvements

It is important to remember that rents actually paid often exclude works of improvement done by the tenant, whereas the value for rating is rebus sic stantibus (ie ‘as it stands’) and includes all rateable improvements (remember to exclude non-rateable plant).

Four main types of improvement are commonly encountered:

- Initial repairs. Where a tenant takes a property in a bad state of repair and, as a condition of the lease, puts the property into a reasonable state of repair, the initial rent will reflect the original state of the building. Clearly, the repairs increase the rental value of the property, and the passing rent should be adjusted to reflect the improved state. See below for a suggested period of amortisation.

- Extensions, alterations and improvements. Works carried out to extend the property will normally increase the rental value and can be taken into account. Alterations can be taken into account to the extent that they are rateable and enhance the rental value of the property. The suggested period of amortisation is set out below. However, although these adjustments can be made, it is frequently more useful to analyse the rent paid on the unimproved building, and then apply this pro-rata to the improved building.

- Fitting out a shell or new building. Where a property is let as a shell, the tenant is responsible for completing or ‘fitting out’ the property. The initial rent generally does not reflect the fitted-out unit. The costs of fitting out can be amortised and added to the initial rent, but may require some adjustment first. Fitting-out costs vary enormously and expenditure on purely personal features of no market value must be deducted from the cost. Non-rateable items must also be deducted.

- Fitting out an existing building. Such matters as shop-fitting, partitioning etc are done to the personal requirements of the tenant. It is essential that such improvements are considered on their merits. Whether or not particular improvements are likely to have general appeal in the market is a matter of judgement.

It is essential to remember that cost does not necessarily equate to value. In Edma Jewellers Ltd v Moore (VO) (1975) the Lands Tribunal considered this issue and concluded that ‘all expenditure must be looked at on its merits’. In the same way you must consider the validity and usefulness of amortised costs to your analysis.

Period of amortisation

- Conditional improvements. The shorter of the following from the date of the improvements:

- the end of the useful life of the improvements; or

- either the next rent review where the improvements are not specified to be disregarded (this would be unusual); or the end of the lease.

- Voluntary improvements. The shorter of the following from the date of the improvements:

- the end of the useful life of the improvements; or

- the next rent review where the value of the improvements is included in the rent;

- the date of the next lease renewal which is neither the first renewal since the improvements were carried out nor within 21 years of their completion;

- exceptionally, where it is known that the lease will not be renewed, the end of the current lease.

Year-to-year assumptions

In the hypothetical world of rating we are assuming a tenancy from year to year, but there is no precedent to suggest that the rent must be reviewed at the end of each year. For rating purposes, rents which arise under leases with review patterns that conform to the market ‘norm’, or shorter review periods, can be accepted without adjustment, but those for longer periods might require adjustment in line with local evidence.

This approach is supported by decisions of the Lands Tribunal. In the absence of any firm evidence to the contrary, they have been reluctant to make adjustments where properties are subject to review patterns which are ‘normal’ in the open market. At present in the UK, rent review patterns are most commonly five-yearly.

The LT have also been willing to accept leases for a term of years certain as good evidence of value, and reluctant to adjust those rents on account of the security they offer. Remember that, in the rating world, the tenancy is not just for a year but has the prospect of continuance.

Be aware that the market ‘norm’ lease lengths can vary greatly between different types of properties. A 15-year lease of 10,000 sq.m city centre offices may be the market norm lease length which commands the best rent, but a 15-year lease of a 200 sq.m industrial unit would generally be regarded as an onerous commitment and warrant a discount, compared with the rents achieved on more flexible three-year leases.

Very short term leases, such as seasonal shops for the sale of fireworks leading to bonfire night, do not represent the demand and rental that tenants are prepared to pay for longer-term occupation, and can usually be rejected as comparable evidence.

Relevant cases are:

- BHS v Burton (VO) and Brighton CBC (1958)

- Walls (VO) v NCP Ltd (1978)

- Cresta Silks Ltd v Peak (VO) (1958)

- FW Woolworth & Co Ltd v Moore (VO) (1978).

Rent-free periods and other concessions

In recent years varying forms of rental incentives have become commonplace, including rent-free periods, stepped rents, and reverse premiums on taking over a tenant’s previous lease. These changes have made it much harder to interpret some market transactions and to determine exactly what the deal equates to, in rental terms.

A rent can be adjusted by amortising the incentives. Adjustments for some of the more common incentives are dealt with below, but remember that if a rent requires significant adjustment, this casts doubt on its worth as a useful piece of rental evidence.

Adjustment periods

Views differ as to the period over which an incentive should be amortised. One view is that an incentive is a payment to the tenant for taking the lease and should be rentalised over the whole length of the lease. An alternative view is that, as the rent is normally subject to review to open market rental value (OMRV), the incentive should only be amortised to the first review. A third view is one of compromise, suggesting a period between the two. The ‘correct’ period over which to rentalise the incentive will ultimately be a question of judgement based upon the type of incentive and local market conditions.

Rent-free periods

Short rent-free periods are often granted to tenants to enable them to complete the fitting out of the property. No adjustment should be made for such a rent-free period, as the concession is only given to allow a tenant to complete works which, in the world of rating, are assumed to be carried out by the landlord. Where the rent-free period does not relate to fitting out or putting into repair, this should be treated as an incentive from the landlord.

It is possible to make the adjustment for a rent-free period into a long and complex operation. However, the practical and accepted method of dealing with it is to consider the length of the rent-free period in the context of possible adjustment times. A long rent-free period may appear to be an incentive to take a long lease, whilst a short period may be a reflection of a slightly over-rented property. It may be necessary to do more than one calculation before drawing a conclusion.

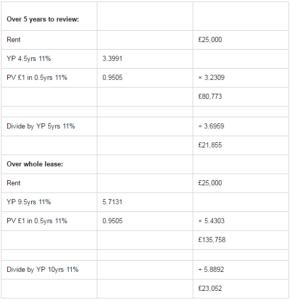

Example 3

A warehouse is let for 10 years at a rent of £25,000 with a review after 5 years. A 6-month rent-free period has been granted by the landlord. This is not for fitting out (the unit is already fitted out), nor is it for disrepair.

From the above information, the rent-free period appears to be an incentive and should be amortised to find the true rental level.

With such a short rent-free period, it is advisable to take a conservative view of the true rental level by taking the first option.

Reverse premiums

This is a sum of money given to the tenant, which can of course be used to pay the rent. It is therefore possible to adjust for such premiums as though they were an equivalent rent-free period, as outlined above. However, you should attach even more caution to amortising premiums and reverse premiums, as the reason for their being paid is often unclear. This also reduces the reliability of the analysed rent as evidence of rateable value.

VAT

Since 1989 landlords have had the option to tax rents - ie charge VAT. For rating purposes the rent has to be adjusted to a rent net of VAT. This is a simple arithmetical calculation. VAT is currently set at 17.5 percent, so if you have a rent which includes VAT, divide it by 1.175 to find the VAT-exclusive rent.

A far more complex issue is the effect of VAT on rental levels. A tenant who is able to recover VAT is relatively unaffected. However, for those tenants who cannot recover the VAT, their occupation costs are higher. These include such occupiers as banks and building societies as well as small businesses that are below the VAT registration threshold.

This has not yet proved to be an issue in the rating world, although a valuer looking at rental evidence must always be aware of the possible uneven effects of VAT on a particular market.

Domestic element

Any part of a rent attributable to residential accommodation, such as in a shop let with a flat, is excluded from business rates and must be stripped out. The amount to be taken is the amount that is considered to be included in the total rent for the domestic part. It is not the amount that the residential accommodation could be sublet for.

Date of rent

It would be unusual for the rental evidence to be conveniently dated at the AVD (although it frequently happens in exam questions!) Typically rents from up to a year either side of the AVD are worth adjusting and analysing (but rents post-AVD may carry less weight; see Hierarchy of evidence above).

Rents agreed more than one year pre-AVD can still be helpful, because they can indicate trends in values. But agreements made a year or more post-AVD are less helpful, because, at the AVD, the hypothetical tenant could not have known of the later transactions.

The valuer must therefore consider whether the rent needs adjusting (upwards or downwards) to reflect rental movements over time. The amount of any adjustment may be derived from the basket of rental evidence gathered, or from other sources such as published data on rental movements - although these are less useful, as they are not specific to the location, nor to the type and quality of property.

Analysis of rents

Once the rents have been adjusted into ‘rent in terms of rateable value’, they can be analysed. In order to make any meaningful comparison of the evidence, the rents must be expressed in terms of a comparative unit, such as £/m², or £/m² ITZA (in terms of Zone A) for retail properties.

Summary

In order to value using the rental method, relevant evidence of open market rental value must be sought. It may be necessary to make adjustments to the rents in order to bring them to ‘rents in terms of rateable value’. It may also be necessary to adjust the comparable evidence to reflect the physical nature of the subject property, eg poor quality or different location. The rents should then be analysed to a comparative basis.

The creation of a basket of evidence is crucial when looking at rental evidence and making adjustments. Remember that the extent of these adjustments reflect the valuer’s opinion of value, not fact.

The results of any analysis using adjusted rents must be set against each other for comparison. Weight must be attached to each piece of evidence, depending on how reliable it is. Then conclusions can be drawn as to what is a reasonable and supportable opinion of Rateable Valuefor a hereditament.

This article was created by --The College of Estate Management 17:07, 6 December 2012 (UTC)