Q.

Bangi White Coffee Sdn Bhd has purchased a double-storey end lot shophouse on 1 June, 2015 for RM1,500,000. On 1 February, 2017 Bangi White Coffee Sdn Bhd manage to sell the shoplot to Footware Sdn Bhd for RM2,500,000.

Below are the information pertaining to the sale and purchase of this property:

i. Payment of estate agent fee (purchase) : RM30,000

ii. Stamp duty : RM38,000

iii. Legal fee (purchase) : RM22,500

iv. Compensation for building fault : RM100,000

v. Renovation cost to the building : RM50,000

vi. Deposit forfeited : RM10,000

vii. Advertisement for sale : RM1,500

viii. Estate agent fee (sale) : RM50,000

Determine the property gains tax and stamp duty for this case. (20 marks)

b) Define the disposal price under the Real Property Gains Tax Act 1976. (5 marks)

(25 marks, 2017 Q6)

A.

a) Question requires both RPGT and Stamp Duty.

RPGT: Bangi White Coffee

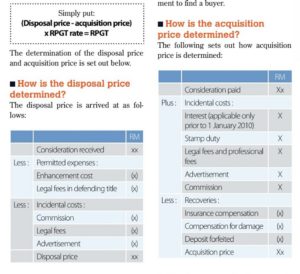

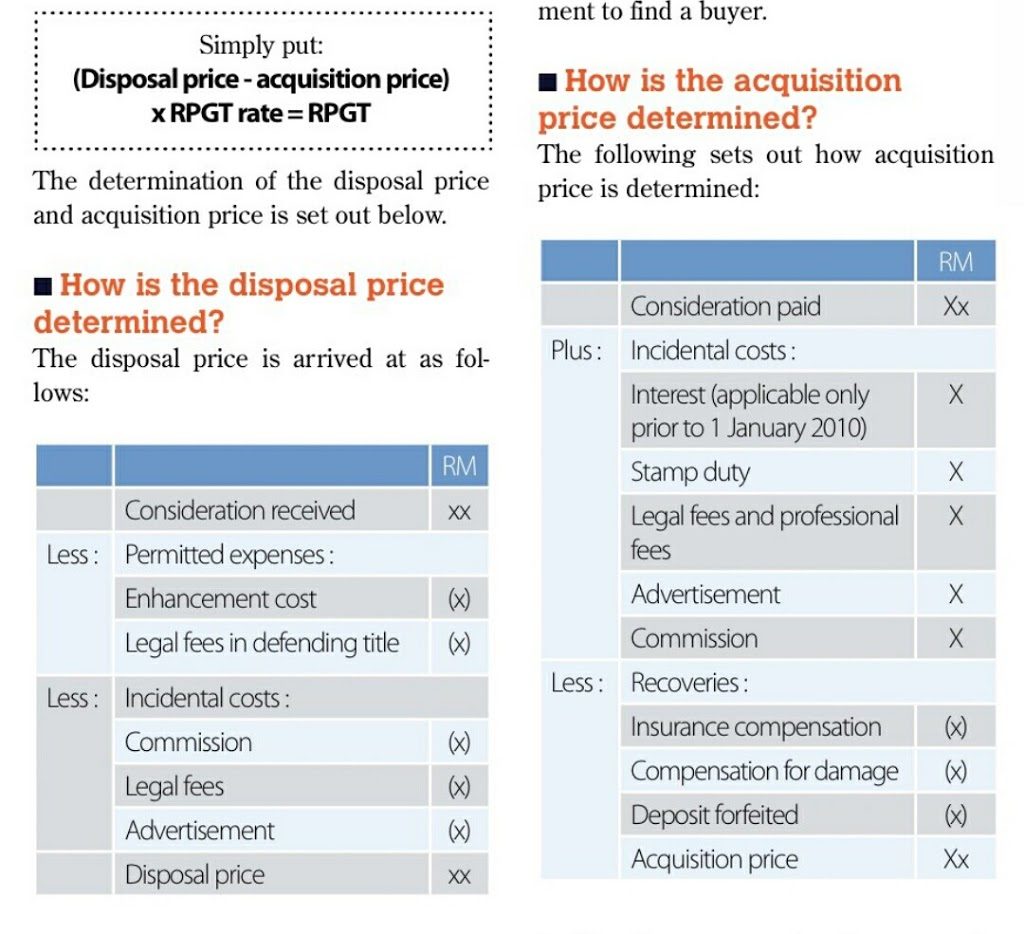

Refer to RPGT format summarized below:

Ref:

SM Thanneermalai. 2010. Real Property Gains Tax 101. Accountants Today. Available at,

http://www.mia.org.my/at/at/2010/10/05.pdf

Disposal Price

Consideration received - RM2,500,000

Less: permitted expenses:

- Renovation cost to the building: RM50,000

Less: incidental cost for sale:

Advertisement for sale: RM1,500

Estate agent fee (sale) : RM50,000

Disposal price = RM2,398,500

Acquisition Price

Consideration paid - RM1,500,000

Plus: incidental costs on purchase:

- Stamp Duty paid: RM38,000

- Agent Fee paid: RM30,000

- Legal Fee paid: RM22,500

Less: recovery cost

- Compensation for building fault: RM100,000

- Deposit forfeited: RM10,000

Acquisition Price = RM1,480,500

Real Property Gains = Disposal Price - Acquisiton Price

=> RM2,398,500 - RM1,480,500 = RM918,000

LESS Sch 4 Exemption of RM10,000 or 10% whichever is greater - 10% of 918,000 = RM91,800

RM918,000 - RM91,800 = RM826,200

* Sch 4 Exemption only applicable to individuals, not for company. So, Bangi White Coffee Sdn Bhd is a company, and hence does not enjoy this exemption.

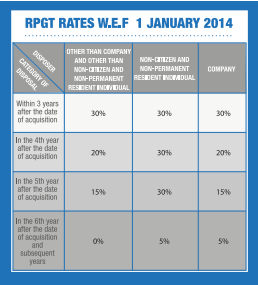

Period where transaction took place:

1st Feb, 2017 - which falls within the Budget 2017.

Years in holding by Bangi White Coffee from acquisition on 1st June, 2015:

1 - Jun - 2015 to 31 - May - 2016 = 1st year

1 - Jun - 2016 to 31 - May 2017 = 2nd year.

Transaction occurred in the 2nd year (1st Feb 2017 fell within 2nd year)

The rate of RPGT on Bangi White Coffee which is a corporation should follow the RPGT rate as below:

Ref:

http://www.hasil.gov.my/pdf/pdfam/13_2017_2.pdf

Which is 30% for disposal within 3 years after the date of acquisition.

RPGT payable = RM918,000 x 30% = RM275,400

Stamp Duty: Bangi White Coffee Sdn Bhd

Under the Stamp Duty Act, 1949, it is specified that Stamp Duty due in a transaction is based on the Consideration paid or Market Value, whichever is the greater.

Bangi White Coffee made a purchase on 1st June 2015 for the corner shop at RM1,500,000. Assuming that there was no open market value higher than this price, stamp duty payable at that time was RM38,000 (given in question), but in fact upon calculation:

100,000 @ 1% = 1,000

400,000 @ 2% = 8,000

1,000,000 @ 3% = 30,000

Total = RM39,000.

Which means RM38,000 as given in the question could be wrong.

Stamp Duty: Footware Sdn Bhd

Purchase price RM2,500,000

100,000 @ 1% = 1,000

400,000 @ 2% = 8,000

2,000,000 @ 3% = 60,000

Total stamp duty payable for Footware = RM69,000

b) Definition of disposal price under the Real Property Gains Tax Act 1976

Schedule 2 Para 5 of RPGT Act 1976 has the below definition of Disposal Price:

Disposal price

5. (1) Subject to subparagraph (2), the disposal price of an asset is the amount or value of the consideration in money or money’s worth for the disposal of the asset less—

- (a) the amount of any expenditure wholly and exclusively incurred on the asset at any time after its acquisition by or on behalf of the disposer for the purpose of enhancing or preserving the value of the asset, being expenditure reflected in the state or nature of the asset at the time of the disposal;

- (b) the amount of any expenditure wholly and exclusively incurred at any time after his acquisition of the asset by the disposer in establishing, preserving or defending his title to, or to a right over, the asset; and

- (c) the incidental costs to the disposer of making the disposal.