Q.

a) With reference to Stamp Duty Act 1949 (Amended), calculate the stamp duty levied for cases below:

i) Ali was selected to purchase a 'Rumah Selangor Ku' for RM150,000.00. This is Ali's first home buyer and all the sale and purchase agreement was signed on 3rd January, 2017. (5 marks)

ii) Grace Sdn Bhd has leased 1,000 square metres retail space at Mall Shopping Centre for RM40.00 per sq metre per month. The lease is for 3+1 years commencing from 1st January, 2017. (5 marks)

b) Using examples explain the fixed and Ad-valorem duties with reference to the 2017 duty rates. (15 marks)

(25 marks, 2017 Q5)

A.

a) Calculate Stamp Duty

Exemption is given for maximum of RM1,000 for the first RM100,000 and the next RM200,000. Which means the total possible exemption Stamp Duty for 2017 is

RM1,000 (1% of 100,000)

RM4,000 (2% of 200,000)

Total exemption = RM5,000.

As Ali's purchase is only RM150,000, he is exempted.

In an effort to reduce the cost of ownership of first home for Malaysian citizens, the government has proposed the following stamp duty exemptions:-

Value of instrument of transfer and loan

RM0 - 300,000 & RM300,001 - 500,000

The above exemption is applicable for sale and purchase agreement executed from 1st January 2017 to 31 December 2018.

See examples of calculation at link below.

Ref:

https://malaysiahousingloan.net/updates-on-stamp-duty-for-year-2017/

Total rental per month is RM40,000, which is RM480,000 per year.

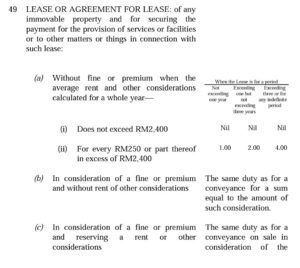

The stamp duty payable is based on Item 49, 1st Schedule of Stamp Act 1949. Extract below:

In excess of RM2,400, for every RM250 there is the duty of RM4, falling under the category of exceeding 3 years or for indefinite period is:

(RM480,000 - RM2,400) / RM250 x RM4

= 1,910.40 x RM4 = RM7,641.60.

b)

Fixed and Ad-valorem duties with reference to the 2017 duty rates

A summary version of Stamp Duty in Malaysia is available at hasilnet website extracted here.

The rates are:

Ref:

https://malaysiahousingloan.net/updates-on-stamp-duty-for-year-2017/

Earlier posts.