Q.

Majlis Daerah Jasin has appointed you to determine the annual value of the following properties for rating purposes.

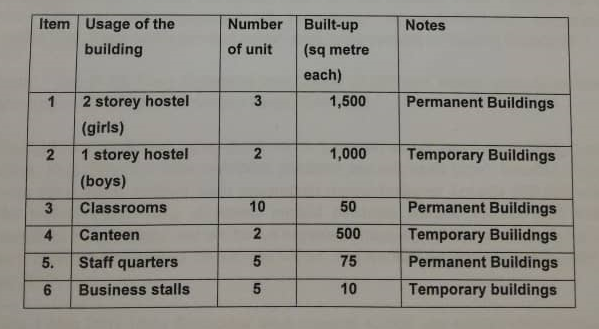

i. A Tahfiz centre for learning Al Quran at Lot 3334, Mukim Durian Sebatang with land area of 4,450 sq metre and the buildings on the site as as follow:

Total number of students population are 500 and paying nominal fee of RM100 per month. 20% of the students are from poor family and were given waiver for fee. The cost to run the Tahfiz is RM30,000 per month.

The business stalls are rented out for RM150.00 per month and only 3 units are operated. The staff quarters are rented out to the staff for RM100 per month inclusive of water and electricity bills. The canteen area is the place to serve the students for their meal free of charge.

Approval from the Majlis Agama Islam and Adat Istiadat Negeri Melaka has been obtained to operate the Tahfiz centre. However, no planning approval have been given to use the agriculture land for this purpose. (12 marks)

ii. A piece of agriculture land with land area of 3.5 hectares planted with Oil Palm trees. The monthly income from the fruit brunch is RM5,000 and the operational cost to up keep the plantation is 30% from gross income. The sales of agriculture land of this nature ranges between RM500,000 to RM650,000 per hectare and the yield is 3%. (8 marks)

(25 marks, 2018 Q2)

A.

The question asks for ANNUAL VALUE. Valuation of holdings should be carried out by valuers. Hence, this question is a blur area with D09 Valuation in Part 2.

Generally, there are 4 main methods in valuation of properties to arrive at Market Value. They are:

1. Comparison method and comparable to adjust to the rightful value.

2. Income method or rental comparison method of valuation

3. Profit/Account method

4. Depreciated replacement/Contractor method/Cost method

Read further in Methods of Property Valuation.

In this question, it has only information of income and expenses, so we would use the income method. Although, rental method is its twin sister (a hypothetical tenant), it is in a way also 'income'.

Definition of "Annual Value" is provided by Local Government Act, 1976 under S.2 as

“annual value” means the estimated gross annual rent at which the holding might reasonably be expected to let from year to year the landlord paying the expenses of repair, insurance, maintenance or upkeep and all public rates and taxes:

It can arrive from two aspects:

- rental value (usually a percentage lower than 35% of annual rental value)

- market value (usually a percentage of 10% or lower of its market value)

If it is a vacant land (therefore unlikely to be rented), a percentage of the market value can be used to arrive at ANNUAL VALUE. Normally, this is 5%.

i) Annual Value of Tahfiz Centre.

Using the Total Income Valuation method, the Tahfiz Centre can generate a yearly income of :

Monthly Income

- From Students = RM100 x 500 - 20% = RM40,000

- From Renting of Stores = RM150 x 3 = RM450

- From Staff quarters = RM100 x 5 = RM500

- Total = RM40,950

- Less Outgoings RM30,000

Net Income per month = RM10,950

Annual income of this holding is RM10,950 x 12 = RM131,400.

*NOT included in the answer but for further reading:

Annual rate (0r consolidated rate) is usually around 35% of Annual Value. Based on the above income (from operating the business = RM131,400), the taxable amount is

RM131,400 x 35% = RM45,990.

However, under normal conditions, the rates imposed around the same area should be used. This 35% is too high, and holdings can object to the rating. Generally, the percentage is below 10%. That means less than RM13,140.

ii) Annual Value of Agricultural land.

Based on Income of this land,

RM5,000 x 12 = RM60,000

Less

- Outgoings - RM18,000 (30%)

- Net Income = RM42,000 per year.

- Yearly Income = RM42,000.

Using Years' Purchase calculation at yield of 3%, the value of this agricultural land is:

RM42,000 x 100 / 3 = RM1,400,000 (market value)

Using percentage market value as Annual Value, Annual Value is RM1.4 million if 10% is taken as according to S.2 of Local Government Act, 1976.

S.2

(c) in the case of any land—

(i) which is partially occupied or partially built upon;

(ii) which is vacant, unoccupied or not built upon;

(iii) with an incomplete building; or

(iv) with a building which has been certified by the local authority to be abandoned or dilapidated or unfit for

human habitation,

(i) which is partially occupied or partially built upon;

(ii) which is vacant, unoccupied or not built upon;

(iii) with an incomplete building; or

(iv) with a building which has been certified by the local authority to be abandoned or dilapidated or unfit for

human habitation,

the annual value shall be, in the case of subparagraph (i), either the annual value as herein before defined or ten per centum of the open market value thereof at the absolute discretion of the Valuation Officer, and in the case of subparagraphs (ii), (iii) and (iv) the annual value shall be ten per centum of the open market value thereof as if, in relation to subparagraphs (iii) and (iv), it were vacant land with no buildings thereon and in all cases the local authority may, with the approval of the State Authority, reduce such percentages to a minimum of five per centum;

Annual Value = RM1,400,000 x 10% = RM140,000.

** If it is a vacant land, it is taken at 5% based on the State Authority approval.

Ref:

Own account.