Q.

a) Explain the difference between firm and industry. (10 marks)

b) Show the equilibrium position of a firm and industry under perfect competition in short-run and long-run. (10 marks)

(20 marks, 2019 Q6)

A.

a) Similar question was asked in:

b) Equilibrium position of firm and industry under perfect competition in Short-Run and Long-Run. Similar answer was provided here.

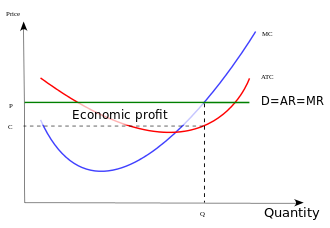

Perfect Competition - SHORT-RUN

In the short run, it is possible for an individual firm to make an economic profit. This situation is shown in this diagram, as the price or average revenue, denoted by P, is above the average cost denoted by C .

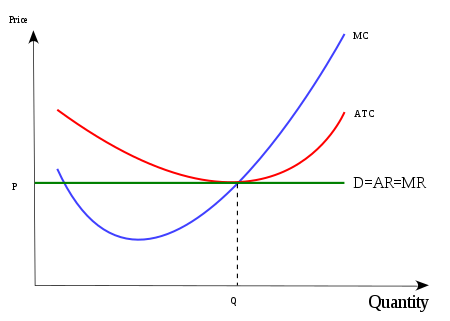

Perfect Competition - LONG-RUN

However, in the long run, economic profit cannot be sustained. The arrival of new firms or expansion of existing firms (if returns to scale are constant) in the market causes the (horizontal) demand curve of each individual firm to shift downward, bringing down at the same time the price, the average revenue and marginal revenue curve. The final outcome is that, in the long run, the firm will make only normal profit (zero economic profit). Its horizontal demand curve will touch its average total cost curve at its lowest point. (See cost curve.)

Perfect competition - SHORT-RUN

In a perfect market the sellers operate at zero economic surplus: sellers make a level of return on investment known as normal profits.

Normal profit is a component of (implicit) costs and not a component of business profit at all. It represents the opportunity cost, as the time that the owner spends running the firm could be spent on running a different firm. The enterprise component of normal profit is thus the profit that a business owner considers necessary to make running the business worth her or his while i.e. it is comparable to the next best amount the entrepreneur could earn doing another job.[7] Particularly if enterprise is not included as a factor of production, it can also be viewed a return to capital for investors including the entrepreneur, equivalent to the return the capital owner could have expected (in a safe investment), plus compensation for risk.[8] In other words, the cost of normal profit varies both within and across industries; it is commensurate with the riskiness associated with each type of investment, as per the risk-return spectrum.

Only normal profits arise in circumstances of perfect competition when long run economic equilibrium is reached; there is no incentive for firms to either enter or leave the industry.[9]

Ref:

Wikipedia "Perfect Competition", available at:

https://en.wikipedia.org/wiki/Perfect_competition

Earlier posts.