Q.

Velerom Sdn Bhd was a controlled Real Estate company formed on 1 March 2015 with the paid up capital of 200,000 ordinary shares of RM1 per share unit. Hany Enterprise owned 40,000 share units in the company. On 1 January 2017, Velerom Sdn Bhd acquired an interest in real property worth RM700,000. On that date, the total tangible a of the company was worth RM1,500,000.

On 1 June 2017, Hany Enterprise acquired an additional 20,000 share units from another shareholder at RM80,000.

Given that the property was situated close to a newly developed business centre, Velerom Sdn Bhd had the property revalued. At the same time, the company had increased its paid up capital to 300,000 share units. From the excess reserve realised through the revaluation, 100,000 units were issued in the form of bonus shares to existing shareholders. Of this Hany Enterprise received 20,000 share units on 1 Jan 2018.

On 1 March 2018, Hany Enterprise sold 40,000 share units at RM250,000 and followed with another sale of RM10,000 share units on 30 June 2018. Hany Enterprise will dispose a further 10,000 share units in year 2019 if there is an offer to purchase the shares at RM6.00 per unit.

a) Calculate the real property gains tax payable in this case. (15 marks)

b) Clarify conditional contract. (5 marks)

c) How are acquisitions and disposals of assets done under conditional contract. (5 marks)

(25 marks, 2019 Q7)

A.

a) RPGT calculation

Velerom Sdn Bhd (hereafter Velerom), which was a control REAL PROPERTY COMPANY since 1 Mar 2015. On 01 January, 2017 Velerom further acquired RM700,000 real property assets making its total tangible assets equivalent to RM1,500,000.

- Velerom -------------Hany -------------- Date RPC 01 Mar 2015 -----Transaction

- 200,000 ------ Share 40,000 + 20,000 (RM80,000) 01 Jun 2017 ----------------A

- 300,000 ------ Share 40,000 + 20,000+20,000 (Bonus Share) 01 Jan 2018 -B

- 300,000 -------Dispose 40,000 (RM250,000) 01 Mar 2018 ------------------------C

- 300,000 -------Dispose RM10,000 (No share mentioned) 30 Jun 2018 -----D

- 300,000 -------Dispose 10,000 (if RM6/share) in 2019 ----------------------------E

Transaction:

A. Hany acquired 20,000 shares from Velerom at RM80,000

When Hany Enterprise (hereafter Hany) which already owned shares (40,000) in Velerom Sdn Bhd acquired further 20,000 shares at RM80,000 on the 1 June 2017 these shares was RPC shares. This is disposal of RPC shares by another Shareholder and is subjected to RPGT.

- 1 Mar 2015 - 28 Feb 2016 - 1st year

- 1 Mar 2016 - 1 Jun 2016 - with 2nd year

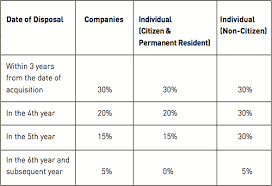

Disposal in 2016 follows RPGT Rates in 2016 which is for company holding RPC Shares, it follows 30% RPGT rate.

RPGT = 30% on gains

- Disposal Price = RM80,000

- Original Price = RM150,000 (RM1,500,000 x 20,000/200,000)

- Loss = (RM70,000)

RPGT payable = 0

(This loss in selling the 20,000 shares to Hany can be brought forward to be deducted from any gains in the future disposal of other shares.)

On the other hand the acquisition price for Hany is RM80,000 for these 20,000 shares. And, subsequent disposal by Hany will be calculated for gains taxable under RPGT on these shares.

B. Bonus issue of shares

Bonus share issued to Hany by Velerom on 01 Jan, 2018 is exempted from RPGT (it is like no gain no loss)

C. Hany disposed of 40,000 shares (which it hold from 1 Mar, 2015) at RM250,000 on 01 Mar 2018

Disposal price = RM250,000

Acquisition price = RM1,500,000 x 40,000/300,000 = RM200,000

Gain = RM250,000 - RM200,000 = RM50,000

As it was transacted outside 3 years (01 Mar 2015 - 01 Mar 2018 = 36 months - 4th year), the RPGT rate is 20%

RPGT payable by Hany = RM50,000 x 20% = RM10,000.

D. Hany disposed of RM10,000 (I think mistake in question - should be 10,000 shares on 30 Jun 2018

As it was transacted within 2 years (01 Jun 2017 - 30 Jun 2018 = 13 months), the RPGT rate is 30%

Assuming that the same price per share was used in this calculation (RM250,000/40,000 shares = RM6.25 / share)

-

- Disposal price = RM6.25 x 10,000 = RM62,500

- Acquisition price = RM80,000 x 10,000/20,000 = RM40,000

- Gain = RM62,500 - RM40,000 = RM22,500

RPGT payable by Hany = RM22,500 x 30% = RM6,750

E. Hany disposed of another 10,000 shares in 2019 if RM6.00 per share.

The remaining 10,000 shares should come from the Shares which was acquired in 1 Jun 2017. If another 10,000 shares are sold in 2019 (within 3 years of the acquisition) the RPGT rate is 30%

Assuming RM6 price per share was used in this calculation

- Disposal price = RM6.00 x 10,000 = RM60,000

- Acquisition price = RM80,000 x 10,000/20,000 = RM40,000

- Gain = RM60,000 - RM40,000 = RM20,000

RPGT payable by Hany = RM20,000 x 30% = RM6,000

Ref:

Own account.

b) Conditional contract.

S. 16 of the Real Property Gains Tax Act, 1976.

16. Where—

(a) a contract for the disposal of an asset is conditional; and

(b) the condition is satisfied (by the exercise of a right under an option or otherwise),

the acquisition and disposal of the asset shall be regarded as taking place at the time the contract was made, unless the amount of the consideration depends wholly or mainly on the value of the asset at the time when the condition is satisfied in which case the acquisition and disposal shall be regarded as taking place when the condition is satisfied."

See below link for this topic.

c) How are acquisitions and disposals of assets done under conditional contract.

The date of Sale and Purchase Agreement is taken as the date of transfer, however with condition (if further approval required).

If conditional to this approval, the date of acquisition and disposal will be dependent on the date when the last condition is satisfied.

Which means, if a Sale and Purchase Agreement is signed on 1 Jan, 2020, with a conditional contract, it means the RPGT dates of disposal is the date of Approval of the Authority (can be State Authority) - which may be months later - for example, 1 Jun, 2020. So, the disposal/acquisition date of the property is NOT 1 Jan, 2020 as in the Sale and Purchase Agreement but 6 months later.

Ref:

Own account.