Q.

What are Local Gov Rates and Cukai Pintu/Cukai Taksiran?

A.

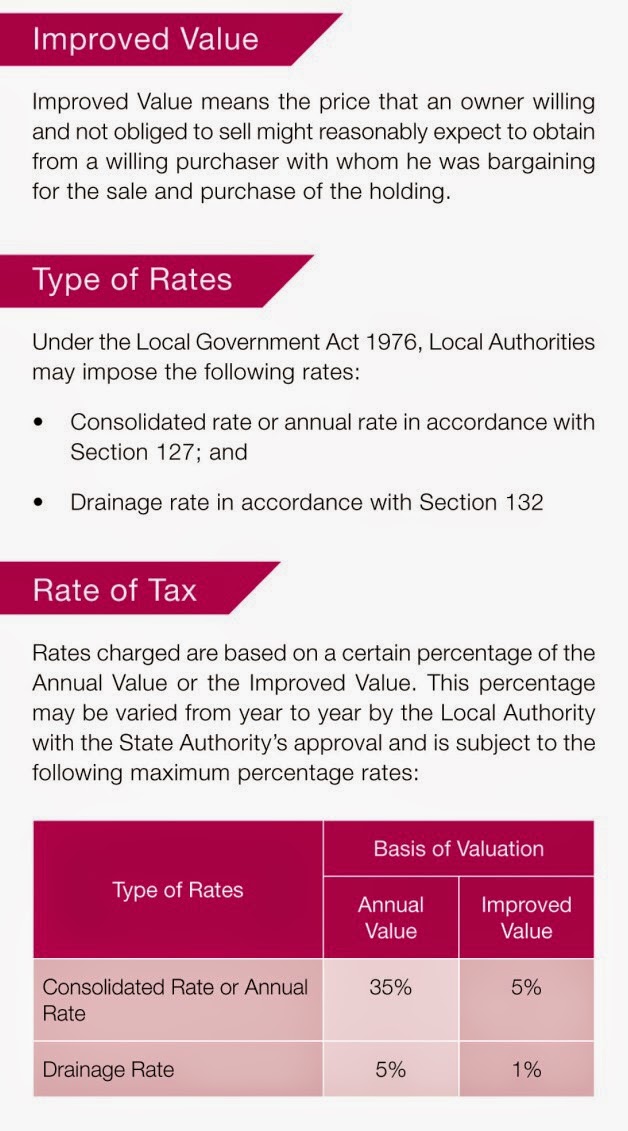

They are taxes collectable by local government for a percentage of annual rentable sum. The law in which it is stated is S.127 of the Local Government Act 1976. An additional 5% can be levied on drainage as stated in S.132 of the same Act. For Sabah and Sarawak, similar laws or ordinances are in place:

[For example, if a property costing RM300,000 can be rented for 600 x 12 = 7,200, an annual value of 7,200 is charged a tax. Some places are between 8-10% payable in half yearly installments.

For MBPJ Selangor, the rate is chargeable at 8.8%, although the law specified that not more than 35% is allowable (RM7,200 x 35% = RM2,520), 8.8% of 7,200 is 633.60 annually or 316.80 every 6 months.

When Improved Value is used, for example this RM300,000 apartment, a 5% annual rate would arrive at RM15,000! So, using Improved Value is heavier than Annual Value at any time!

This phenomenon is seen due to the extreme appreciation of property prices in recent time, much had been owing to speculative buying.

Take for example a similar apartment, which costs RM100,000 in the old days. The Improved Rate would be RM100,000 x 5% = RM5,000. The Annual Value would likely be lower at RM300 x 12 = RM3,600. So, the annual rate or consolidated rate would be:

- RM5,000 - based on Improved Value; or

- RM1,260 (RM3,600 x 35%) - based on Annual Value.

Of course, the lower value is usually used. So, even 35% of the Annual Value, which from above is RM1,260 is considered too high. A 8% rate of the Annual Value is likely used. So, 8% of RM3,600 is RM288.]

Ref:

JPPH Website from: http://www.jpph.gov.my/mobile/pdf/Rating.pdf

[X] Own account.