Q.

Summer Sdn Bhd bought 2 units of industrial buildings from Hana Development Bhd on November 2015. Summer Sdn Bhd had paid 1.5% fee to estate agent from the purchase price of RM4.8 million. The company has also paid fee to MPC Property Consultant for the valuation report. The valuation fee of RM25,000 is paid before loan application is applied to the Bank Pembangunan Berhad.

In June 2016, an explosion happened to the building owned by Summer Sdn Bhd and both buildings were badly damaged. The compensation claimed to the Syarikat Insuran Berlian was released in December 2016. The total compensation was RM1.15 million. To avoid the same incident happen again, Summer Sdn Bhd has installed a better fire detector in both the industrial buildings. Cost to purchase and installed the unit was RM520,000.

Summer Sdn Bhd sold both industrial buildings for RM8.5 millions in January 2018 through an estate agent. Fee of 1% was paid to the agent. For the purpose of preparing sales and purchase agreement, lawyer has been appointed with a fee of RM425,000.

Determine the total amount of tax that need to be paid.

(25 marks, 2018 Q4)

A.

REAL PROPERTY GAINS TAX

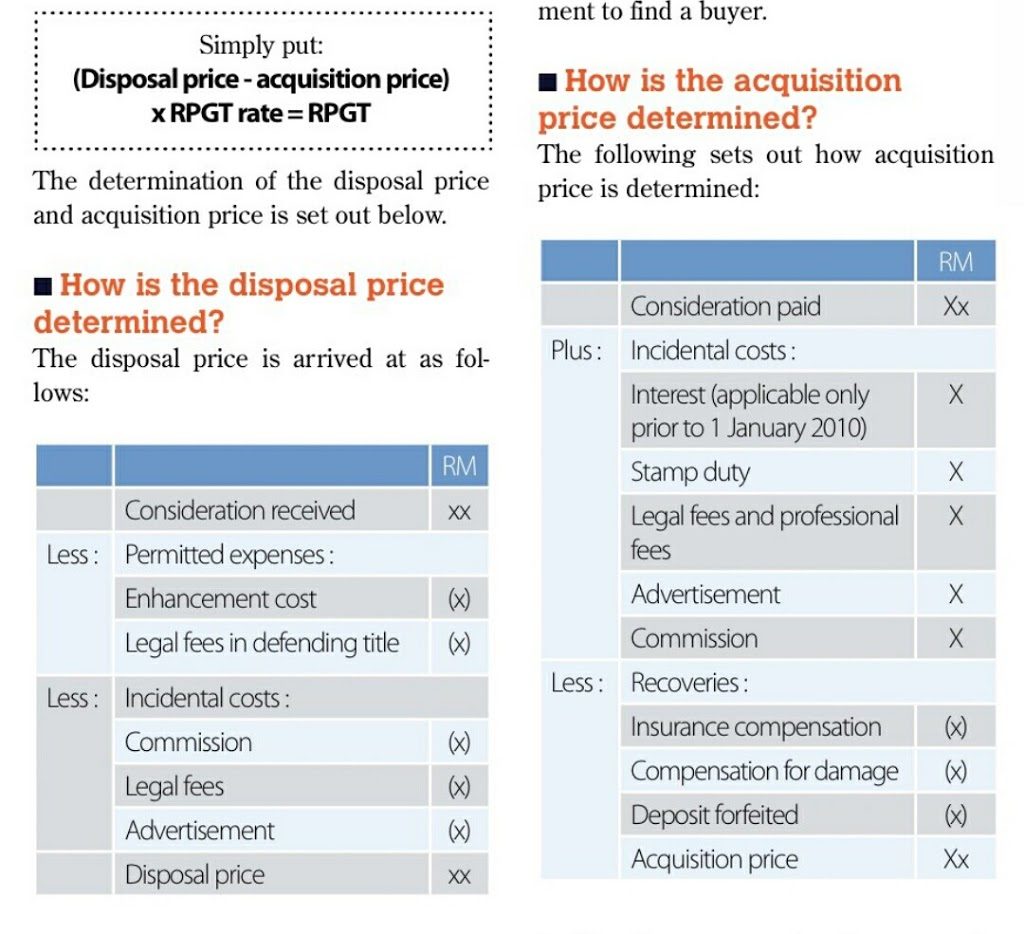

It is good to refer back to the format of calculation of RPGT.

Hana SOLD--> Summer --------------------------------> SOLD

-----------------Explosion Compensation----------------

-----------------Nov2015 ------Jun2016 ---Dec2016 ----Jan2018

***Acquisition Price:

Consideration paid = RM4,800,000

Add:

- Agent's fee = 1.5% @ RM72,000

- Valuer's fee = RM25,000

- Stamp Duty = RM138,000

- (1% of first 100,000 = RM1,000, 2% of Next 400,000 = RM8,000, and 3% of Next 4,300,000 = RM129,000)

- 6% GST =RM288,000

Less:

- Recoveries = RM1,150,000 (Compensation)

Total Acquisition price = RM4,173,000

***Disposal Price:

Consideration received = RM8,500,000

Less:

- Enhancement = RM520,000 (fire detector)

- Estate agent fee = RM85,000@1%

- Legal fee = RM425,000

Total Disposal price = RM7,470,000

Gain = RM7,470,000 - RM4,173,000 = RM3,297,000

This RPGT gain is levied a tax according to the time disposal has taken place subsequent to acquisition below:

- Nov 2015 - Nov 2016 = 1st year

- Nov 2016 - Nov 2017 = 2nd year

- Nov 2017 - Nov 2018 = 3rd year

Date of disposal was in Jan, 2018, hence it was disposed off within 3rd years. The RPGT tax rate is 30%.

RPGT taxable = RM3,297,000 x 30% = RM989,100

*Being a company Summer Sdn Bhd does not enjoy the Sch 4 Exemption for individual (10% or RM10,000 exemption wherever is higher) or the "once in a life time" exemption.

STAMP DUTY

On acquisition:

- 1% of first 100,000 = RM1,000,

- 2% of Next 400,000 = RM8,000, and

- 3% of Next 4,300,000 = RM129,000

Total Stamp Duty = RM138,000

Nominal fee of RM10 per copy for the duplicate copies of the Stamping of Sale & Purchase Agreement.

On disposal:

Nominal fee of RM10 per copy for the duplicate copies of the Stamping of Sale & Purchase Agreement.

Ref:

Own account.