Q.

Discuss the followings:

a) Elaborate two (2) approaches to determine the Value of a premise for rating purpose. (5 marks)

b) Land Premium and Additional Premium. (5 marks)

c) With example explain the rate for 2017 stamp duty, what are fixed duty and ad-valorem duty. (10 marks)

(25 marks, 2018 Q7)

A.

a) Annual Value and Improved Value

b) Land Premium and Additional Premium

c) Fixed duty and ad valorem duty

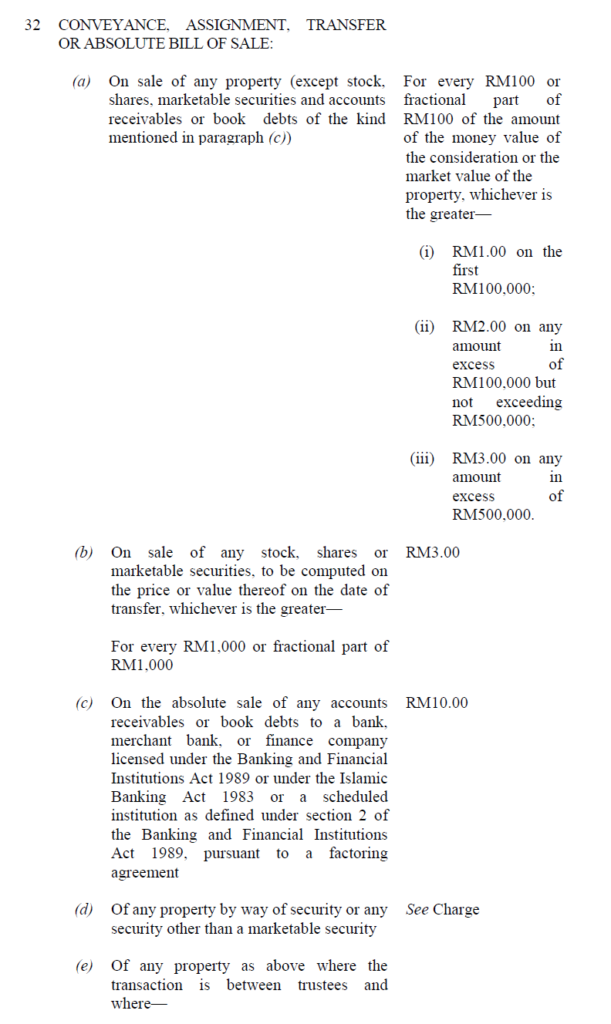

Fixed and Ad-valorem duties with reference to the 2017 duty rates

A summary version of Stamp Duty in Malaysia is available at hasilnet website extracted here.

The rates are:

Although scale of 4% was never introduced in 2018, based on popular objection.

- Example of a Fixed Duty - is stamp duty for stamping documents like RM10 for a statutory declaration.

- Example of Ad Valorem duty - is stamp duty for stamping an agreement like RM9,000 for a Sale and Purchase Agreement for a transaction of RM500,000 property.

- 1% for first 100,000 = RM1,000

- 2% for the next 400,000 = RM8,000

- Total Stamp Duty (Ad Valorem) = RM9,000.

1st Schedule of Stamp Act, 1949 extracted below to show the various stamp duties.

Ref:

Earlier posts.