Q.

The National Budget for the year 2019 has reviewed items on Stamp Duty and Real Property Gains Tax. There were also clauses regarding a moratorium period in their implementations. Explain the matters that have been approved by Parliament pertaining to these issues and the rates that have been proposed.

(25 marks, 2019 Q2)

A.

STAMP DUTY - 2019 BUDGET

4% stamp duty for property price which has exceeding RM1,000,000; meaning that above RM1,000,000 (amount exceeding RM1mio), the exceeded sum will be levied 4% stamp duty.

For example, RM1.5 million property will have RM1.5m - RM1.0m (RM500,000) x 4% be added into the stamp duty calculation.

This was delayed and not introduced.

Media Release: Stamp Duty Exemption For First Home Purchases During The Home Ownership Campaign Is Extended For Six Month Until 31 December 2019.

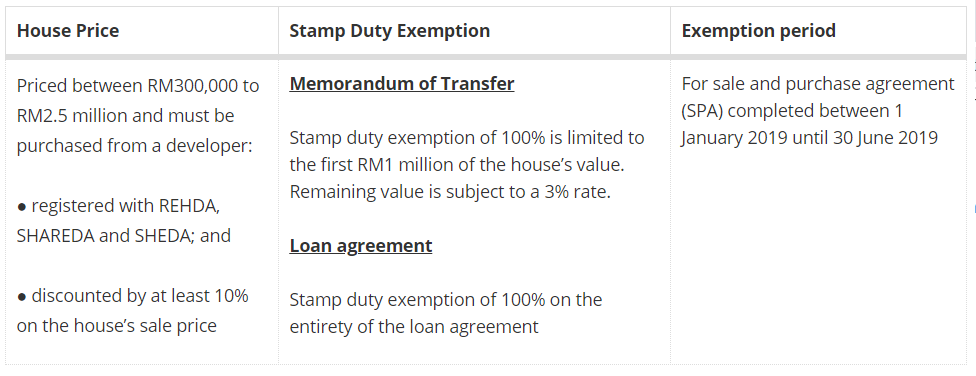

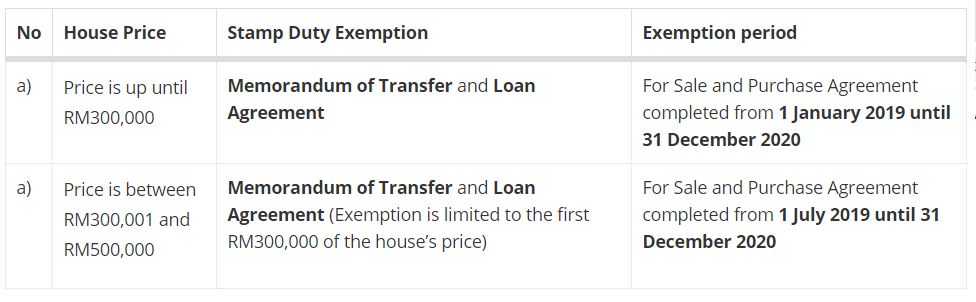

Stamp Duty Exemptions for Transfers and Loan Agreements for Properties Purchased under the National Home Ownership Campaign 2019.

In the Budget 2019, the Finance Minister of Malaysia announced that as one of the measures to address the issue of property overhang, the Government will waive stamp duties for first time purchases of homes valued between RM300,001 and RM1 million under the National Home Ownership Campaign 2019 (‘NHOC 2019’).

Subsequently, the Finance Minister announced a further three measures to boost the sale of residential property at NHOC 2019. First, the stamp duty on a transfer will be waived on the first RM1.0 million in value of residential properties valued at up to RM2.5 million. Second, stamp duty will be charged at a rate of 3% instead of 4% in respect of the value of the property exceeding RM1.0 million but up to RM2.5 million. Third, stamp duty exemption will be granted for loan agreements for properties valued between RM300,001 to RM2.5 million.[1]

Stamp Duty (Exemption) (No.2) 2019 and Stamp Duty (Exemption) (No.3) 2019, which are deemed to have comes into operation retrospectively on 1 January 2019, were gazetted on 19 March 2019 to give effect to above-referred measures.

Stamp Duty (Exemption) (No.2) Order 2019 (‘E.O. 2/19’) exempts from stamp duty any loan agreement to finance the purchase of a residential property under the NHOC 2019, which is valued at more than RM300,000 but not more than RM2.5 million, and is executed between an individual and any of the financial institutions listed in sub-paragraphs (1)(a) – (1)(i) of Paragraph 2 of E.O. 2/19.

Stamp Duty (Exemption) (No.3) Order 2019 (‘E.O. 3/19’) provides that any instrument of transfer for the purchase of a residential property under the NHOC 2019, which is valued at more than RM300,000 but not more than RM2.5 million, and is executed by an individual is exempted from stamp duty in respect of RM1 million and below of the value of the residential property.

The exemptions under E.O. 2/19 and E.O. 3/19 shall only be granted if –

the sale and purchase agreement (‘SPA’) for the purchase of the residential property is executed on or after 1 January 2019 but not later than 30 June 2019 and is stamped at any branch of the Inland Revenue Board Malaysia;

- the SPA for the purchase of the residential property is between an individual and a property developer; and

- the purchase price in the SPA is a price after a discount of 10% by the property developer, except where the residential property is subject to controlled pricing.

For the purposes of E.O. 3/19 -

- the value of the residential property is to be based on the market value; and

- stamp duty of RM3 is charged for every RM100 of the balance amount of the value of the residential property which is in excess of RM1 million.

The application for exemptions under both E.O. 2/19 and E.O.3/19 must be accompanied by a NHOC 2019 Certification issued by the Real Estate and Housing Developers’ Association Malaysia (‘REHDA’), Sabah Housing and Real Estate Developers’ Association (‘SHAREDA’) or Sarawak Housing and Real Estate Developers’ Association (‘SHEDA’).

For the purposes of both E.O. 2/19 and E.O.3/19 -

- ‘residential property’ means a house, condominium unit, an apartment or a flat purchased or obtained solely to be used as a dwelling house and includes a service apartment for which the property developer has obtained an approval for a Developer’s Licence and Advertising and Sales Permit under the Housing Development (Control and Licensing) Act 1966, the Housing Development (Control and Licensing) Enactment 1978 of Sabah or Housing Development (Control and Licensing) Ordinance 2013 of Sarawak;

- ‘individual’ means a purchaser who is Malaysian citizen or co-purchasers who are Malaysian citizens; and

- ‘property developer’ means a property developer registered under REHDA, SHAREDA or SHEDA.

Based on a reading of E.O. 2/19 and E.O. 3/19, it appears that the exemptions granted under those instruments are not restricted to first time purchasers of residential property.

[1] See: ‘Government announces additional incentives for Home Ownership Campaign’, The SunDaily, 31 January 2019.

Ref:

https://www.skrine.com/insights/alerts/march/stamp-duty-exemptions-for-transfers-and-loan-agree

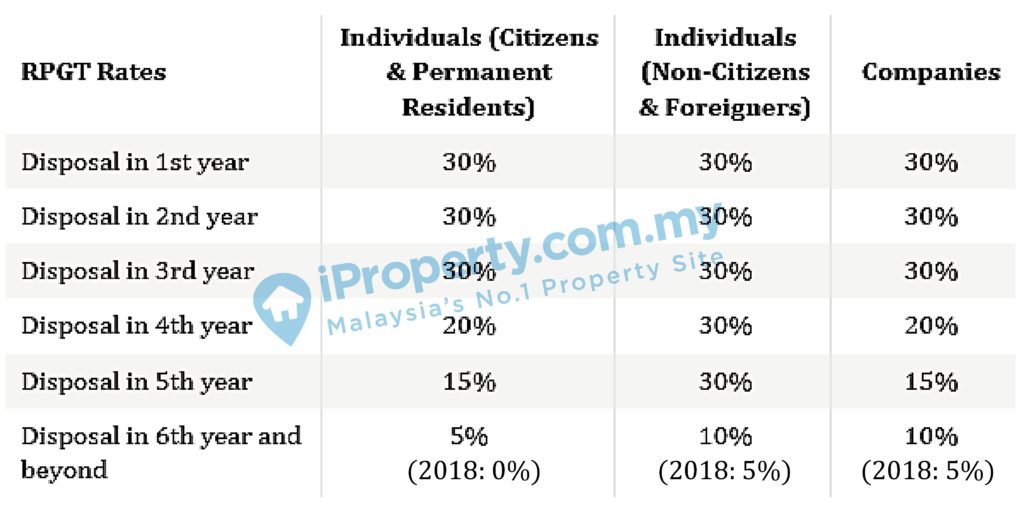

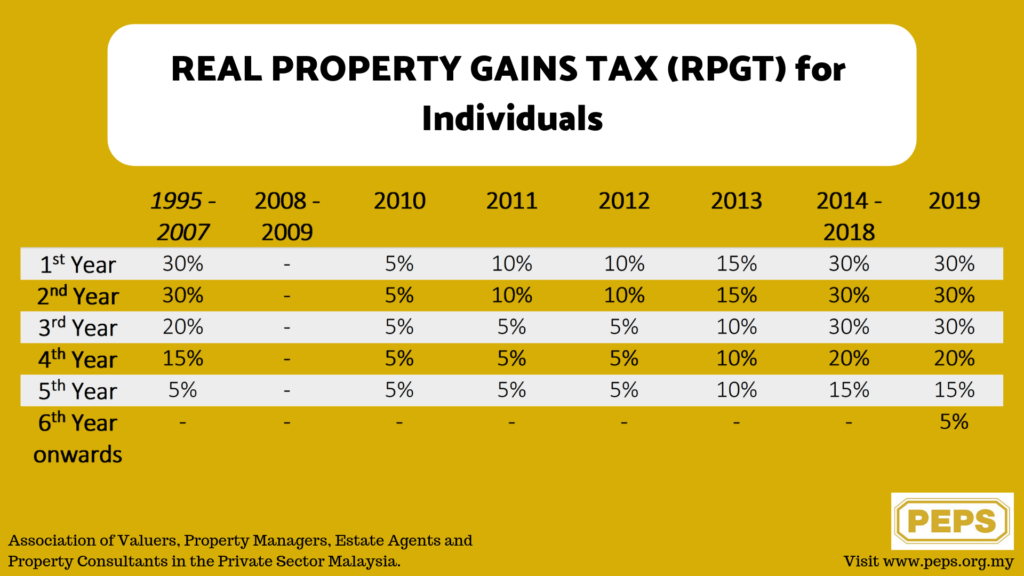

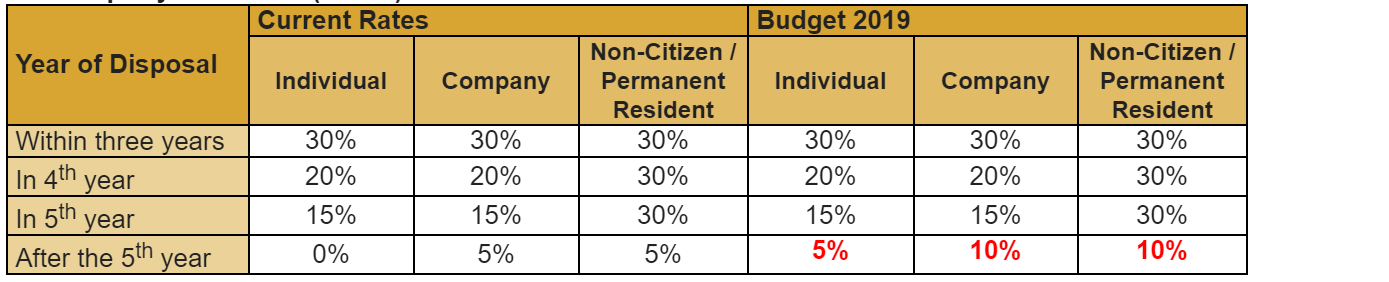

REAL PROPERTY GAINS TAX - 2019 BUDGET

Valuation year

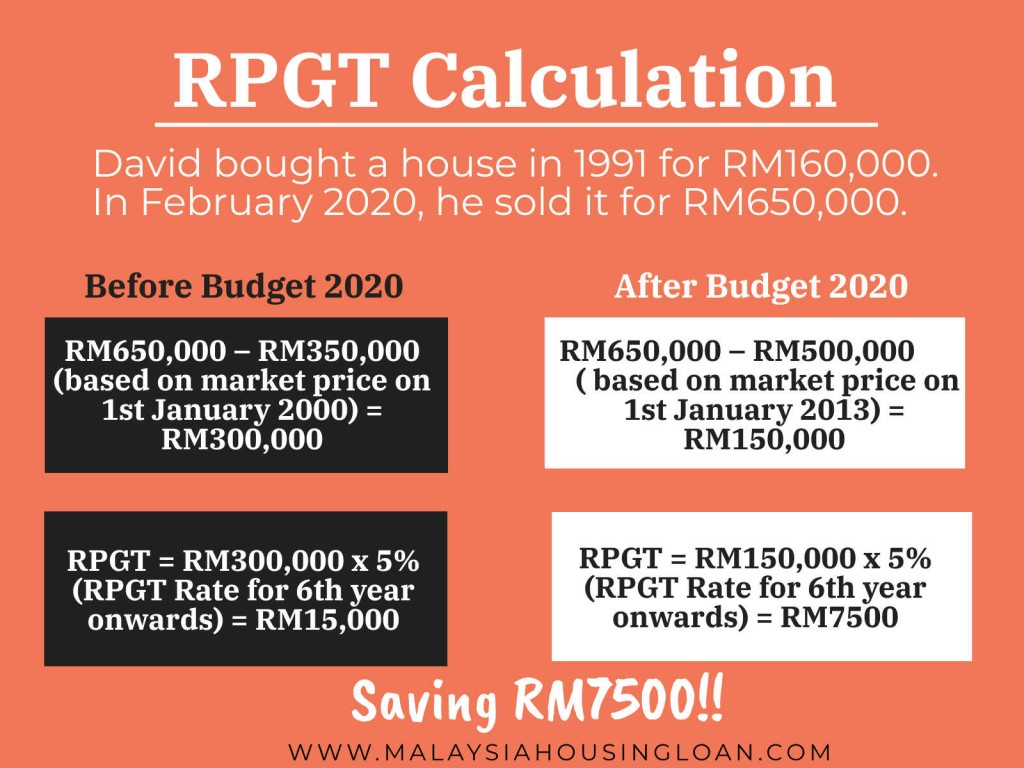

In the 2019 budget, property holding exceeding 5 years will be imposed RPGT of 5% on the gains irrespective of how long it has been held. The base year on the value is year 2000.

This means when an inheritance of property from as old as 1980s will be valued at year 2000 for its acquisition price, and the gains be calculated based on current disposal price less this acquisition price. This gains will be levied 5% RPGT. However, this has been changed in BUDGET 2020 to be valued base year 2013. Please see illustration below:

Ref:

https://malaysiahousingloan.com/real-property-gain-tax-malaysia/