Q.

a) Lot 456, Section 5, Town of Kuala Lumpur with the land area of 20,000 square feet is zoned for commercial use with the plot ration of 1:7.0 and plinth area of 60%. The owner has proposals for a building with a built-up area of 250,000 square feet and 150 car parking bays. Due to the location of the lot close to a MRT Station it is classified as a TOD development and therefore gets a relief of 50% for the car parking bay requirement.

The Development Charge imposed by DBKL is at RM15.00 per square foot for every additional square foot floor area and RM60,000 for every shortfall of car parking bay. Calculate the development charge levy if the proposed development is granted planning permission. (15 marks)

b) With examples explains another two (2) situations where Development Charge may be levied other than 3 (a). (10 marks)

(25 marks, 2019 Q3)

A.

a) Kuala Lumpur - land area of 20,000 square feet is zoned for commercial use with the plot ration of 1:7.0 and plinth area of 60%.

Proposal:

- Building with a built-up area of 250,000 square feet

- 150 car parking bays

- a relief of 50% for the car parking

The definition of Plot Ratio is:

From S.2 of Town and Country Planning Act, 1976,

“plot ratio” means the ratio of the total floor area of a building to the area of the building plot as measured between the survey boundary lines or, if there are no survey boundary lines, between the provisional boundary lines;

Plinth area will determine the base of the Building. In this case Plinth Area of 60%, which means the total land area can allocate maximum 60% to be its area cover by the building.

Based on the proposal, the area covered with building should be :

20,000 sqf x 60% = 12,000 sqf.

And, when this is used to build multi-storey building, the total floor area should be maximum at this plot ratio of 1:7.0, which is

20,000 x 7.0 = 140,000 sqf

140,000 / 12,000 = 11.7 floors (maximum allowed by Planning Authority = 11 floors)

250,000 / 12,000 = 20.8 floors (proposal wanted to build 21 floors)

The proposed development has exceeded

250,000 - 140,000 = 110,000 sqf.

The development charge for the square footage exceeded is:

RM15.00 x 110,000 = RM1,650,000.

Car Parking

However, there are 3 zones where development charges are levied differently. This is to differentiate population density and traffic of vehicles at the regions.

Zone 1 is city center and Zone 2 and Zone 3 are outskirt. Hence, Zone 1 more densely populated. Therefore, the land is more expensive and thus the amount of land available for use as car park might be limited. Hence, the planning of car parks cannot be as demanding as less populated area.

In a nutshell, the more densely populated the zone is, the lesser it is feasible to have large number of car parks. In other words, for a city centre, the car park number per square footage would be less than outside the city where land is in abundance.

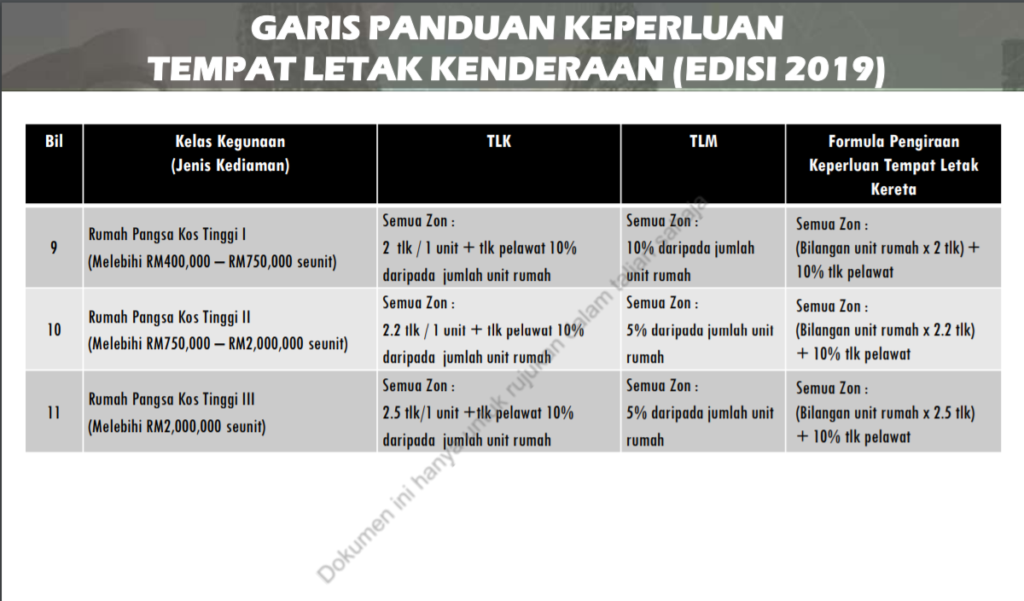

Usually, the allocation of car parking is based on residential development where a unit of service apartment (on commercial land) should have at least a car park. Some luxury condo would have 2 car parks (based on Housing Development (Control & Licensing) Act 1966 - Schedule H for strata residential. Moreover, there shall be allocation of visitor car parks in proportion to the numbers of resident car parks. This can be shown in the slide below.

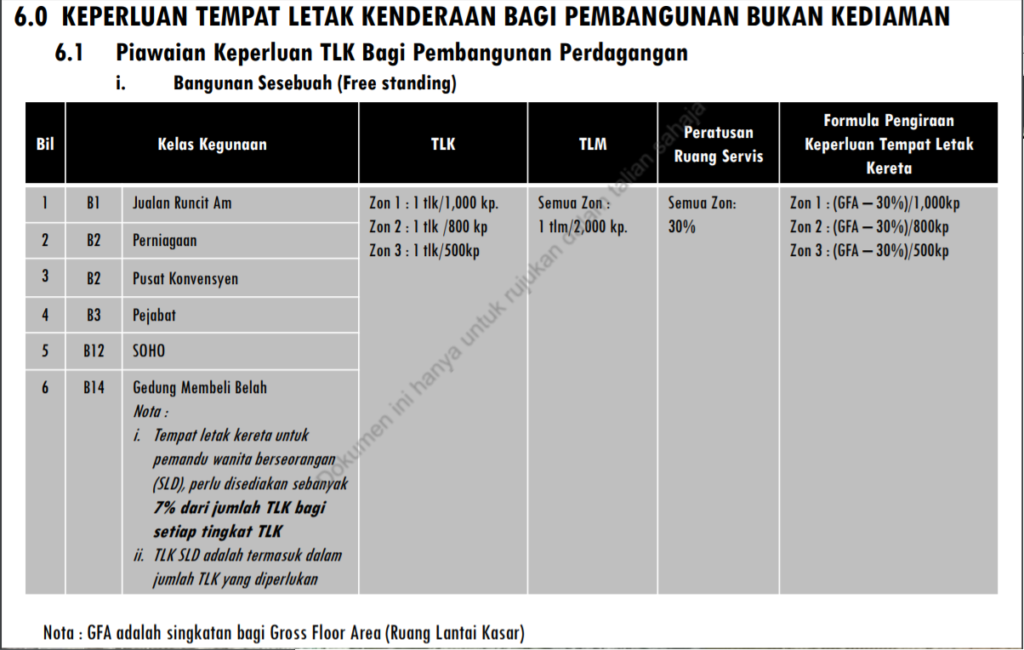

However, this question is about commercial use of the land, and there is no mention of residential apartment on top of the commercial block. Hence, we assume the allocation of car parks is base on commercial use as shown below.

Gross Floor Area (GFA) for this development is 250,000 sqf. Based on the assumption that the car park allocation for this development which includes Eateries, Entertainment, Cinema, Gym & Healthcare services, the numbers are:

Zone 1 & 2, (GFA - 30%)/600 sqf = (250,000 - 30%)/600 = 292

Zone 3 (GFA - 30%)/500 sqf = (250,000 - 30%)/500 = 350

Assuming this development of Lot 456, Section 5 is in ZONE 2, we would use 292. This means, in order to develop this area for commercial purposes, the planning authority would want to see at least 292 car parks being allocated.

Now, there is a 50% of relief because it is next to a MRT and classified under TOD (Transit-Oriented Development). Which means due to public transport being available, there is less demand for car parking. 292 x 50% = 146 car parks required.

Therefore, 146 is the required car park number for this development.

Thus, there is no shortage of car parking as the proposal already provided 150 car parks.

Total Development Charge (Zone 2) payable is RM1,650,000

HOWEVER, if it is in Zone 3, the required number of car parking will be 350.

With 50% relief, it is still 175 and short by 25 (175 - 150). The amount of development charge payable for this shortage is

RM60,000 x 25 = RM1,500,000. Hence, the total Development Charge payable will be

RM1,650,000 + RM1,500,000 = RM3,150,000

Total Development Charge (Zone 3) payable is RM3,150,000

Ref:

Garis Panduan Perancangan Keperluan Tempat Letak Kenderaan Edisi 2019 (KUALA LUMPUR)

http://www.dbkl.gov.my/index.php?option=com_jdownloads&Itemid=692&view=finish&cid=1004&catid=107&m=0&lang=ms

b) Another two (2) situations where Development Charge may be levied.

Federal Territory (Planning) Act 1982 is similar to TCPA in majority cases of the laws, however limited to Federal Territory Kuala Lumpur, Putra Jaya, Labuan and Langkawi. The purpose of the Act is as follows:

"An Act to make provisions for the control and regulating of proper planning in the Federal Territory, for the levying of development charges, and for purposes connected therewith or ancillary thereto."

For the most part, the power is vested in the hands of the Federal Territory Minister.

Section 40 of the Federal Territory (Planning) Act 1982;

40. (1) Where a local plan or an alteration of a local plan effects a change of use, density, plot ratio or floor area in respect of any land so as to enhance the value of the land, a development charge at the prescribed rates shall be levied in respect of any development of the land commenced, undertaken, or carried out in accordance with the change.

- Change of use (type - residential becomes commercial)

- Change of density (higher plot ratio)

- Change of area of use (higher plinth area)

The above example in 3a was on change of plot ratio (meaning change of density).

The other two situations for development charge to be levied are:

- Change of use.

- Change of area.

Change of use

This is straight forward for type of use (or category of land use) from:

- Agricultural use to residential use (Building)

- Residential use (building) to Commercial use (building)

- Agricultural use to Industrial use

Change of area

Plinth area is the area use for building, and the remaining area of land is left as empty space.

For example, plinth area of 60% means on a 10,000 square feet land, 6,000 square feet area is covered with building.

This plinth area when is increased, like extension of another building next to it, will incur development charge.

Take for example, a residential house needed to extend its wet kitchen. Its original plinth area is 60%, 40% of empty space. Now, with this extension, the wet kitchen takes up another 10% of the space, it becomes 70% plinth area. This extra 10% will be levied a development charge.

Further reading on Federal Territory (Planning) Act, 1982 is available below.

Ref:

Own account.

2011 Q1 impact of development charge for property owners

2012 Q2 why developer has to pay development charge

2013 Q4 landowner serves a notice to the local authority to acquire his land

2014 Q7 part on impact of development charge for property owners

2015 Q1b calculation scenario Ahmad

2015 Q4 calculation of development charge

2016 Q4 calculation of development charge

2019 Q3 calculation of development charge for Car Parks (This question)