Q.

a) With reference to the Income Tax Act 1967, explain the following:

i. Chargeable Income

ii. Capital Allowance (6 marks)

b) State two (2) conditions that need to be fulfilled by Malaysian Residents in order to pay income tax for the year of assessment 2018. (5 marks)

c) State eight (8) reliefs that can be claimed for the year of assessment 2018. (8 marks)

d) Explain the income tax rates for firms/corporations for the year of assessment 2018. (6 marks)

(25 marks, 2019 Q6)

A.

a) Explain

i) Chargeable income

“chargeable income” in relation to a person and a year of assessment, means chargeable income ascertained in accordance with this Act;

Above is the interpretation under S.2 of the Income Tax Act 1967.

Chargeable income has two interpretations:

- The type of incomes which are chargeable to income tax,

- The amount of income which are levied the income tax.

Chargeable income classes include:

Section 4 of the Income Tax Act, 1967, which includes:

Classes of income on which tax is chargeable

4. Subject to this Act, the income upon which tax is chargeable under this Act is income in respect of—

(a) gains or profits from a business, for whatever period of time carried on;

(b) gains or profits from an employment;

(c) dividends, interest or discounts;

(d) rents, royalties or premiums;

(e) pensions, annuities or other periodical payments not falling under any of the foregoing paragraphs;

(f) gains or profits not falling under any of the foregoing paragraphs.

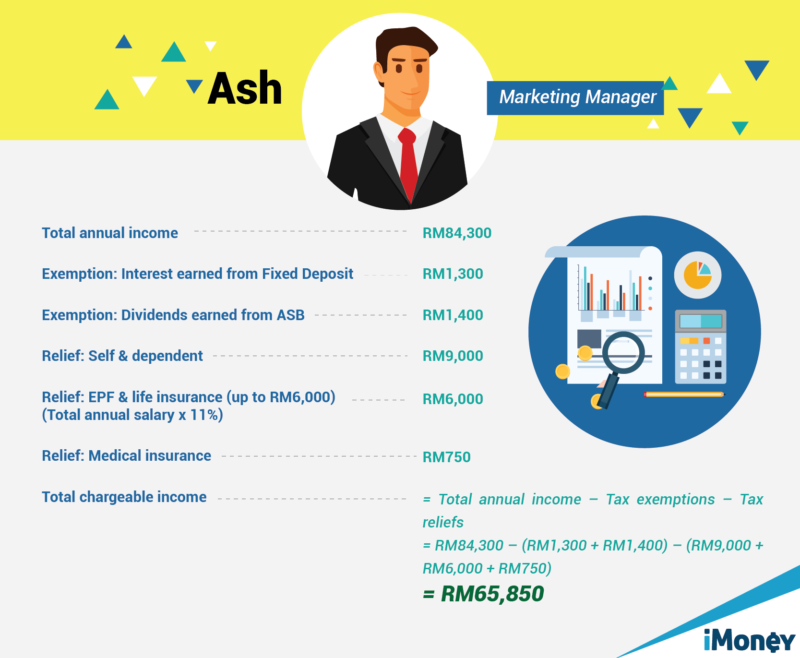

And, when an individual is a Resident for tax payment during a period, the "chargeable income" is obtained from taking his total income less the allowable reliefs and deductions to arrive at a "chargeable income". This amount is levied a scaled rate for the total income tax payable.

On the computation of the chargeable amount, it depends on

- determining if it is an individual, corporate entity or society.

- Second, if the party is a resident tax payer during that period.

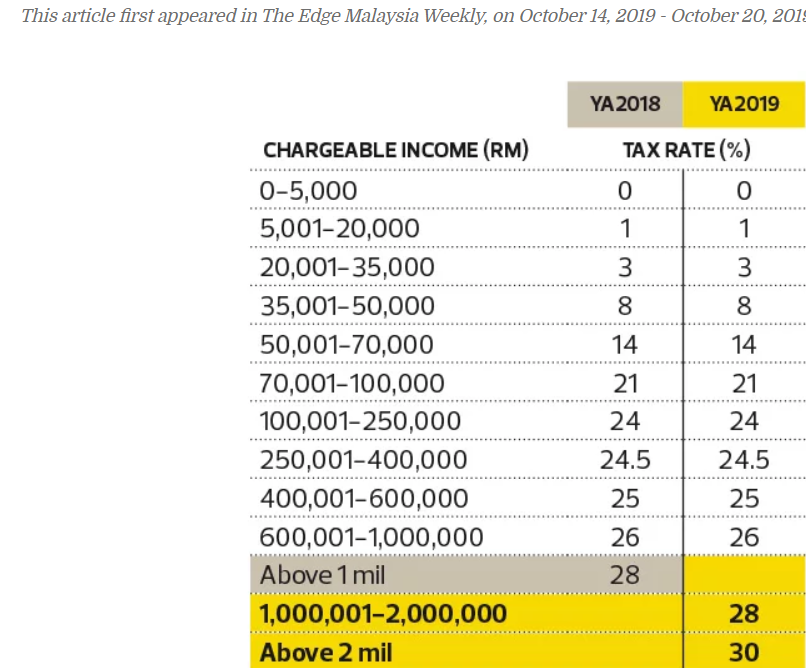

The rates of income tax varies with the above conditions:

For individual who is a tax resident (182 days in Malaysia), the below tax rate applies onto the chargeable income:

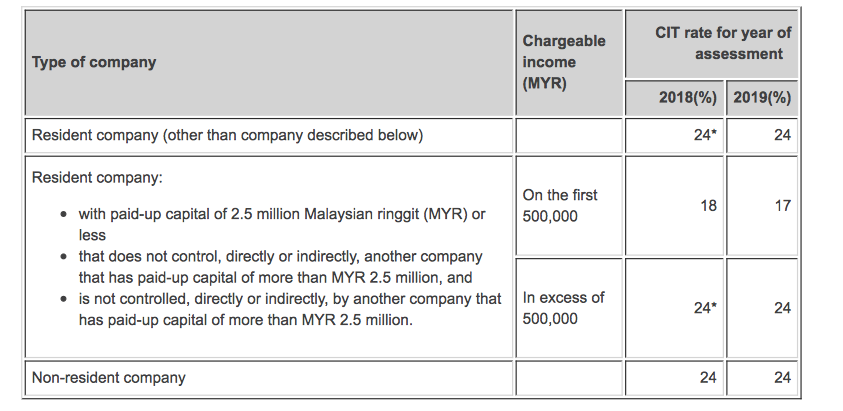

However, if it is a corporation, the income tax treatment is different. It does not have a scale rate or marginal tax rate (on progressive tax system). The flat income tax is levied - 24% as for current year (2019).

Ref:

Own account.

ii) Capital allowance

Because "Chargeable Income" and "Capital Allowance" are just part questions in this whole question, I do NOT think a complete answer is required. Hence, a summary short answer would be enough.

From HasilNet, it is given the below explanation.

Capital allowance is only applicable to business activity and not for individual. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. Some examples of assets that are normally used in business are motor vehicles, machines, office equipment and furniture.

In order to qualify, expenditure must be capital in nature and used for business purposes. Claims for capital allowance can be made in the relevant column provided in the Tax Return Form.

In determining the business adjusted income during the basis period, no deductions are allowed for expenditures which are capital in nature or depreciation value for the assets which are used in the production of that business income. However, Schedule 3 of the Income Tax Act 1967 has laid down several allowable deductions in the form of allowances, for the capital expenditures that have been incurred.

Capital allowances consist of an initial allowance and annual allowance. Initial allowance is fixed at the rate of 20% based on the original cost of the asset at the time when the capital expenditure is incurred.

While annual allowance is a flat rate given every year based on the original cost of the asset. The annual allowance is given for each year until the capital expenditure has been fully written off, unless the fixed asset is sold, scrapped or disposed, in which case a balancing allowance or balancing charge will be calculated.

Ref:

https://www.hasilnet.org.my/capital-allowance-types-rates/

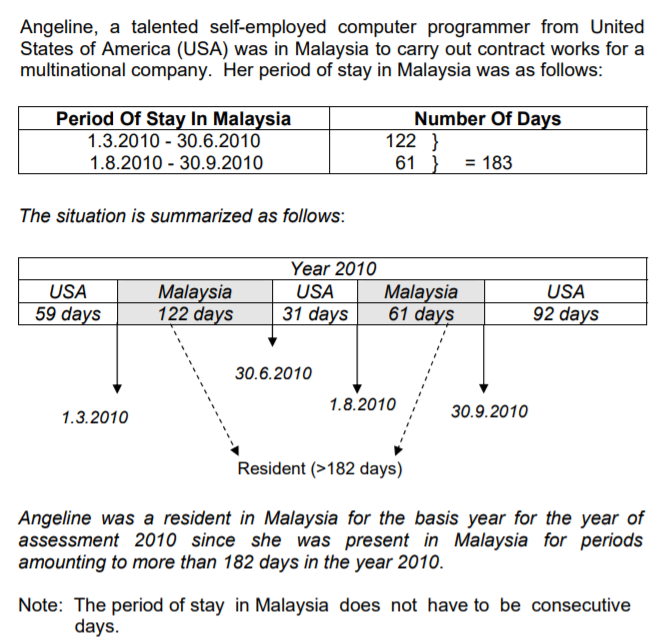

b) Two (2) conditions that need to be fulfilled by Malaysian Residents in order to pay income tax for the year of assessment 2018

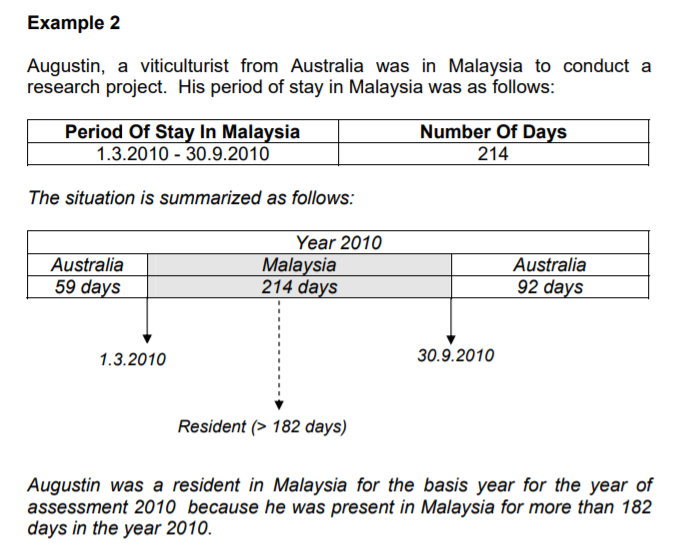

Residence: individuals

7. (1) For the purposes of this Act, an individual is resident in Malaysia for the basis year for a particular year of assessment if—

(a) he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty two days or more;

(b) he is in Malaysia in that basis year for a period of less than one hundred and eighty-two days and that period is linked by or to another period of one hundred and eighty-two or more consecutive days (hereinafter referred to in this paragraph as such period) throughout which he is in Malaysia in the basis year for the year of assessment immediately preceding that particular year of assessment or in that basis year for the year of assessment immediately following that particular year of assessment:

Provided that any temporary absence from Malaysia—

(i) connected with his service in Malaysia and owing to service matters or attending conferences or seminars or study abroad;

(ii) owing to ill-health involving himself or a member of his immediate family; and

(iii) in respect of social visits not exceeding fourteen days in the aggregate, shall be taken to form part of such period or that period, as the case may be, if he is in Malaysia immediately prior to and after that temporary absence;

More of the various ways to qualify as resident can be obtained from link below.

http://www.hasil.gov.my/pdf/pdfam/PR6_2011.pdf

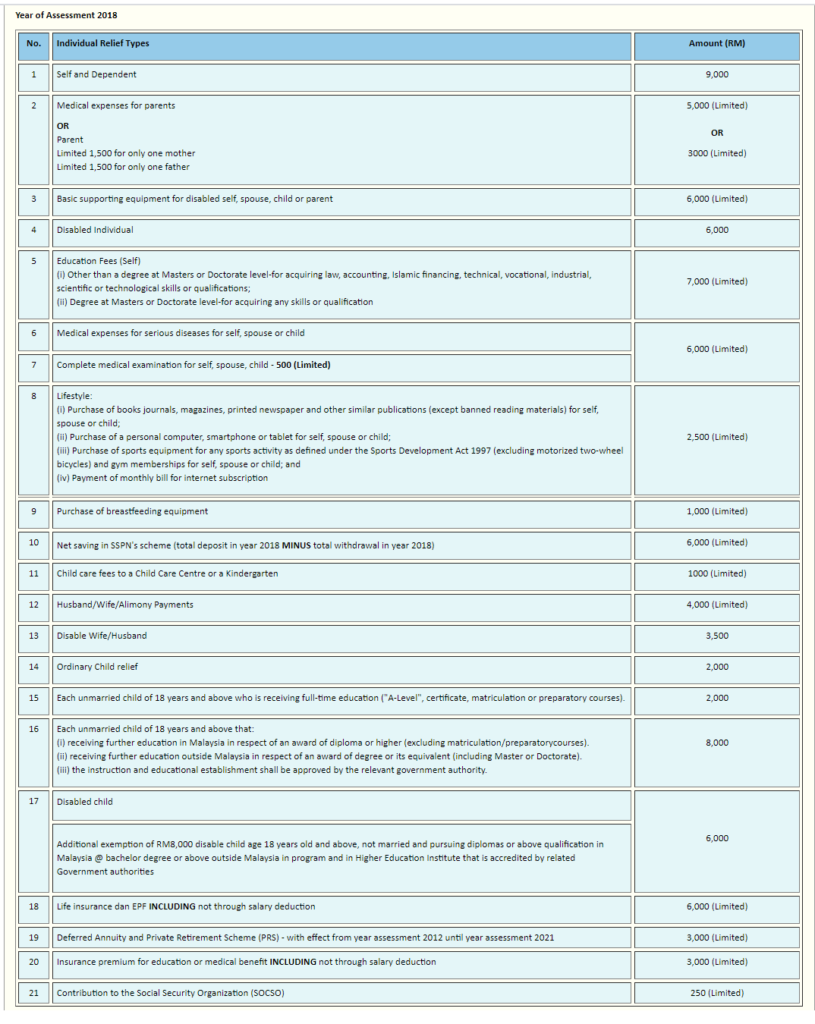

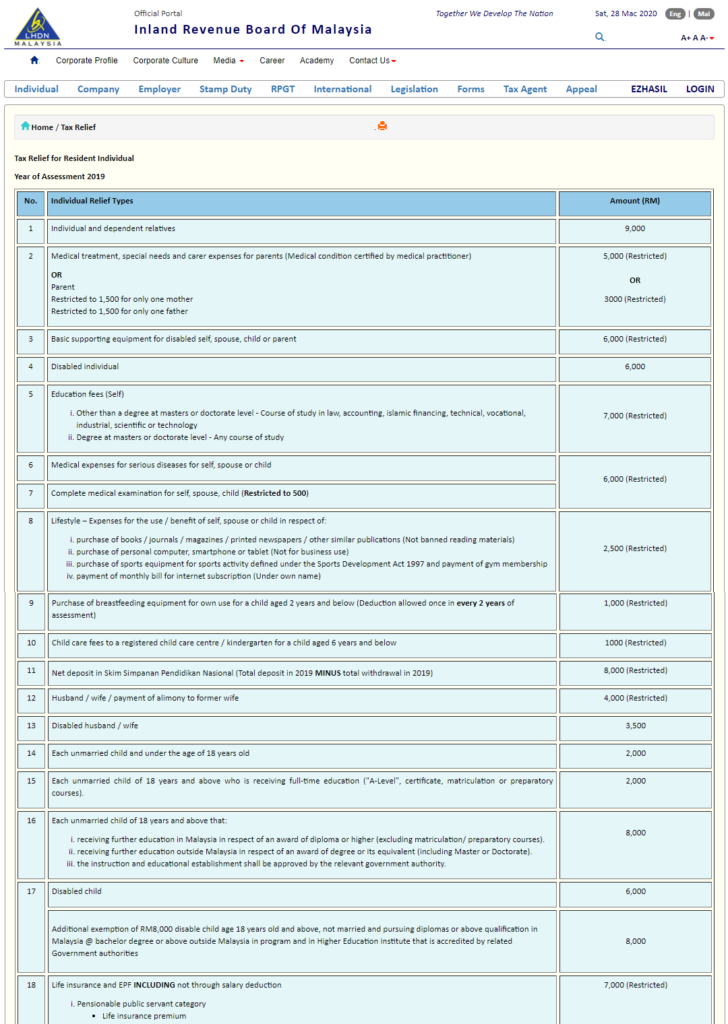

c) Eight (8) reliefs that can be claimed for the year of assessment 2018

For 2019, refer below:

Ref:

http://www.hasil.gov.my/

Look under "Individual" and "Tax relief".

d) Income tax rates for firms/corporations for the year of assessment 2018

See similar table as above under "Chargeable Income".

Corporate Income Tax Rates

The Current Income Tax Rates in Malaysia is explored above

* For years of assessment 2017 and 2018, CIT is reduced based on the incremental chargeable income for companies, limited liability partnerships, trust bodies, executor of estate of an individual domiciled outside Malaysia at the time of death, and receiver appointed by the court.

Ref:

https://formis-training.com/preparing-for-2019-malaysian-tax-season/