Q. There is initial duty and additional duty. What is ‘advance duty’? A. The issue of initial duty and additional duty came about because private valuer come out with different Read More …

Tag: 1.4

Stamp Duty in Malaysia – A quick look

Q.Can you provide a simple summary of stamp duty chargeable in Malaysia? A.In Malaysia, Stamp duty is a tax levied on a variety of written instruments specifies in the First Read More …

Valuation List amendment and calculation of Annual Value Q1

Q. Upon the implementation of Local Government Act 1976, City Hall of Kuala Lumpur has several times prepared new valuation list. As per the said Act, the new valuation list Read More …

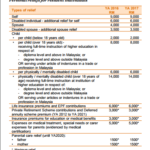

Income Tax relief items and life style tax relief Q2

Q.a) Explain ten (10) items that could be given tax relief under the assessment of Income Tax 2017. (20 marks) b) Discuss the life style tax relief for 2017 assessment Read More …

Land Titles and Reverting title back to SA Q3

Q. a) Explain the items below: i) Land Office Title (5 marks) ii) Land Registry Title (5 marks) iii) Stratum Title (5 marks) iv) Strata Title (5 marks) b) State Read More …

Development Charge and En Wahab Calculation of Q4

Q. a) With reference to Town and Country Planning Act, 1976 (amended), explain with examples why the land owner is required to pay Development Charge. (15 marks) b) Encik Wahab Read More …

Stamp Duty calculation and Fixed v Ad Valorem Duties Q5

Q. a) With reference to Stamp Duty Act 1949 (Amended), calculate the stamp duty levied for cases below: i) Ali was selected to purchase a ‘Rumah Selangor Ku’ for RM150,000.00. Read More …

RPGT Calculation Bangi White Coffee Q6

Q. Bangi White Coffee Sdn Bhd has purchased a double-storey end lot shophouse on 1 June, 2015 for RM1,500,000. On 1 February, 2017 Bangi White Coffee Sdn Bhd manage to Read More …

Rates Contribution, Exempted and Premium & Additional Premium Q7

Q. Explain the followings: i) Contribution to rates (5 marks) ii) Exempted rates (12 marks) iii) Premium and additional premium (8 marks) (25 marks, 2017 Q7) A. i) Contribution to Read More …

Rental method of rating valuation

Q. What is rental method of rating valuation and when should it be used? A. Go here to read the article from its original site. This is verbatim from the original Read More …

Managing property of the deceased

Q. How to transfer property of a person who recently passed on? A. I recently come across this issue with my auntie, who suffered a stroke during an operation. She Read More …

What do you mean by ‘DISITA’?

Q. When a holding has arrears unpaid, the local government can pursue legal action to siege the holding. Explain the law involved in this process. What is From H? A. Read More …

Contribution in Aid of Rates vs Rating and Additional Premium Q1

Q. (a) Explain the differences between ‘Contribution in Aid of Rates’ and Rating. (10 marks) (b) Additional Premium will be imposed if the State Authority approves application to any changes Read More …

Valuation List preparation & Annual Value Q2

Q.With reference to Local Government Act 1976 (As amended), explain: (a) the steps taken by a local authority to prepare and implement a new Valuation List. (20 marks) (b) determination Read More …

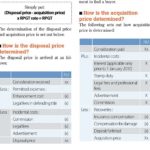

Factory Building RPGT Calculation Q3

Q.(a) Under the Real Property Gains Tax Act 1976, explain the following: i) Incidental Cost (5 marks)ii) Disposal Price (5 marks) (b) Alex bought a double storey factory building from Read More …

Development Charge Calculations Q4

Q. With reference to Town and Country Planning Act 1976 (As amended), calculate the total Development Charge of the following: (a) Nazri proposed to develop a housing scheme of 200 Read More …

Income Tax exemptions & Deductible Expenses on Rental Q5

Q. With reference to the Income Tax Act 1967 (as amended), (a) State any FIVE (5) classes of income that are exempted from Income Tax. (10 marks) (b) With examples, Read More …

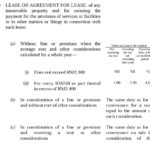

Objection to, Initial Duty & Additional Duty Q6

Q. With reference to the Stamp Act 1949 (As amended), (a) Explain the procedure for objection by the purchaser who is dissatisfied with the duty imposed by the Collector of Read More …

Valuation List & Assessment Tax Q7

Q. (a) With reference to Local Government Act 1976 (As amended), explain FIVE (5) reasons for the amendment of Valuation List. (10 marks) (b) Imran has bought a double Storey Read More …

Stamp Duty for Rental

Q. If I have a property rental per month of RM1,600 and the tenancy agreement is for a period of 24 months, how much stamping fee would it be? (Assuming Read More …