Q.

If I have a property rental per month of RM1,600 and the tenancy agreement is for a period of 24 months, how much stamping fee would it be?

(Assuming that I need to produce a copy to the tenant, and I keep the original)

A.

Earlier posts were:

2015 Q6c - lease of retail space.

Stamp Duty on SPA Loan and Rental.

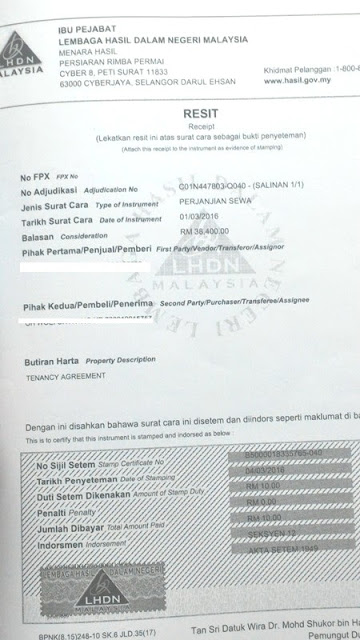

The pictures below show the Stamp Duty paid for the above tenancy agreement, for original and salinan.

The calculation is as shown below:

1. First calculate the total annual rental collection

- 1,600 x 12 = 19,200

2. The first 2,400 of rental collection is exempted from stamp duty

- 19,200 - 2,400 = 16,800

3. For the multiplier to calculate the stamp duty, ie RM250,

- RM16,800 / RM250 = 67.20

4. Round up (NOT round down!) to the nearest whole number

- 67.20 becomes 68

5. Use this figure to multiply by the Rate as per Item 49 (a), Stamp Act 1949. In this case, it is RM2 per tenancy of more than 1 year, less than 3 years. (1<x<4)

- RM2 x 68 = RM136

The duplicate copy (Salinan) is rated for stamp duty of RM10.00 per copy.

Hence, the total amount due to Inland Revenue for Stamp Duty on the above Rental (Commercial Shop Lot) is:

Tenancy Agreement Original - RM136.00

Tenancy Agreement Duplicate - RM10.00

Total = RM146.00

Based on Stamp Act 1949, 1st Schedule [Section 4] Instruments Chargeable with Stamp Duty, Item 49 Lease or agreement for lease, a) as image below:

Ref:

Own account with earlier postings.

Item 49, 1st Schedule, Stamp Act 1949.